MicroAngel State of the Fund: December 2023

Holiday break, revenue contraction from seasonality + actual churn. Installs slightly down. 30 day revenue: $28.2k

Good morning and evening friends!

This will be a short one as I’ve been moving around for the past few weeks, with more travel ahead, and limited opportunity to write.

It’s important that I reset my brain and body a little bit, but even more so based on this month’s results and the attention I’ll need to give to the apps on my return.

I think December was our worst month yet in terms of MRR growth. I’m pretty bummed out to be closing the growth stage with two straight down months.

I don’t want to hide behind seasonality despite having data showing it had an impact.

It’s clear the Shopify app store changes have negatively impacted not just my apps but also the apps of other developers not in the 95th percentile of rankings.

There’s a case to be made here for pushing off roll-up until recovery is made, but there isn’t anything specific one can point to that has created the effect I’m observing.

Nothing has fundamentally changed on any of the apps, but both experienced greater than usual churn.

For the first time ever, Reconcilely posted two double-digit churn months. It had never had a double-digit churn month before (notwithstanding the months following the launch of the product).

I’m not particularly concerned — because the products haven’t changed — but do intend to action some items against these results.

Namely, I’ll need to focus just about all of my time to recover the app’s rankings on the Shopify App Store as the current situation can simply be described as less installs and more churn.

Not something I’d want to either let happen, roll-up with, or hand-off to a buyer. This needs to be fixed, so that’s what we’ll do.

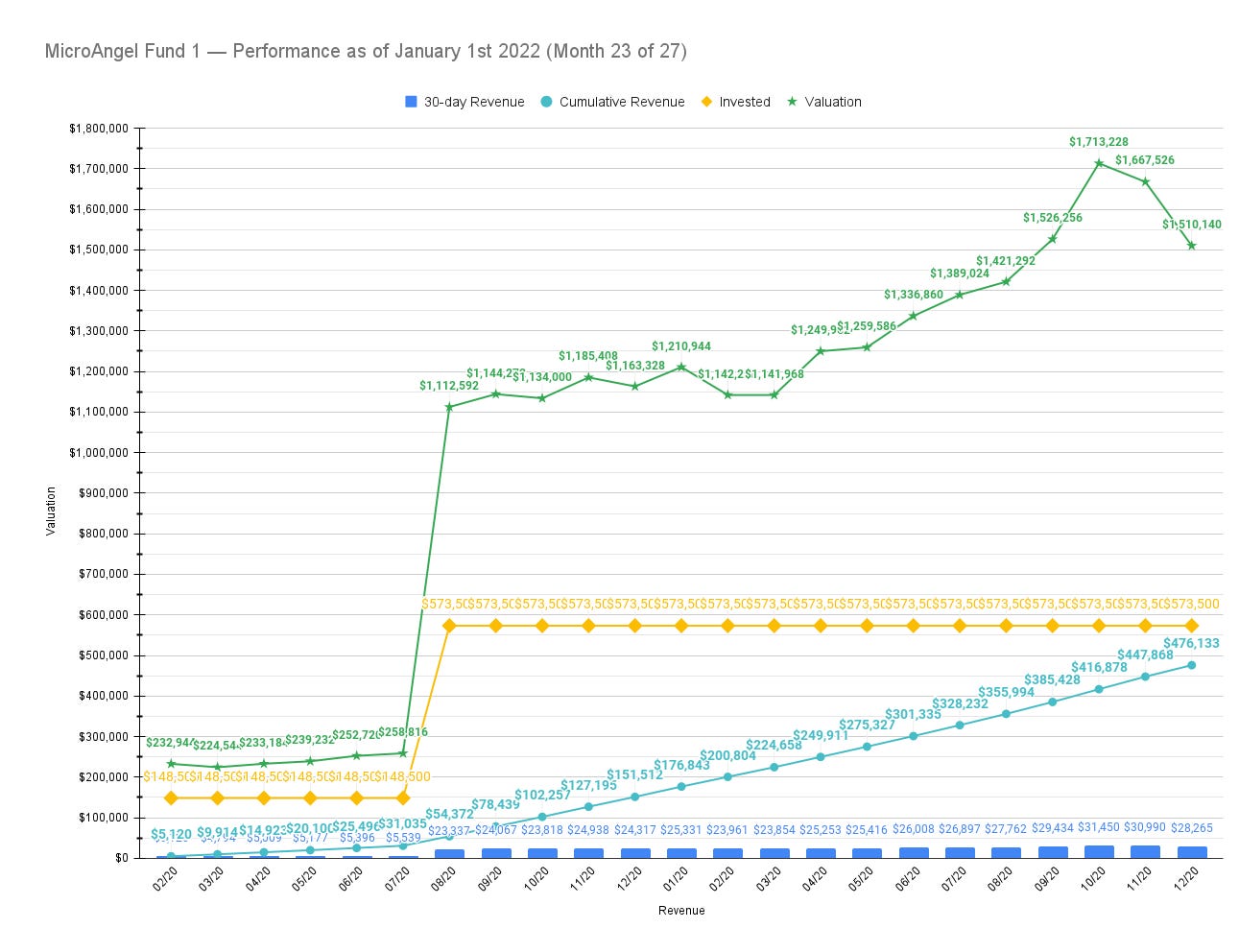

As of today though, Fund 1 performance breakdown goes as follows:

capital invested 21 months ago: $573.5k

cash returns collected: $476.14k

current cash-on-cash rate: 4.9% monthly, 59% annually

portfolio valuation: $1.51m

total value against invested capital: $1.99m

total multiple on invested capital: 3.46x

This past month has been quite slow in terms of production considering the end of year holidays and any travels implied by the new year.

We made some very large strides in terms of performance optimization for Reconcilely, migrating away from IBM’s Compose for the database over to Heroku, mostly as a factor of consolidating access and resources on that platform.

That move saved about $300/mo, and rapidly increased the speed of the application, which has a tangible impact on the user experience contained.

Churn was greater than normal, but what hurt us was refunds — and this month’s refunds came from a single customer in a story that all but infuriated me tbh

A customer had signed up for a $1,000 plan but had forgotten to use their trial. No worries, we said, we’ll extend the trial into the new year by a month.

Regardless of why, the customer insisted on being refunded so they could sign up again in the new year when they were ready to use their trial.

Not really a problem in of itself, as things should cancel out.

But not quite! As a partner, when I process a refund, it is immediately deducted from any upcoming payouts. The payment made by the customer never actually gets cancelled on the card. It just gets cancelled out by being refunded on the next bill.

The issue with this is that I’m financing those refunds as a partner. I incur the cashflow impact of that refund immediately, and only observe that revenue later on when the payment (that was to be refunded) gets processed into the next partner payout.

This is unacceptable in my view, but I’m not going to scream and shout about it. It’s just another brick in the wall as far as working in the Shopify ecosystem is implied.

If you’re planning on working on a Shopify app, make sure you’re working on a piece of the workflow that is aligned with what the company messaging is currently (or will be) about, otherwise you’ll find yourself paddling more often than you benefit from the ecosystem’s built-in demand for apps.

In the end, I’m most annoyed by the timing of the results than the results themselves as it means I have to shift my focus at the last moment.

I can begin to prepare Postcode Shipping for a transaction, but I think I’ll need to hold on to Reconcilely for a little while longer so I can make adjustments and/or observe an end to current seasonal effects on churn and installs.

Current fund lifecycle stage

✅ Buying (02/2021 - 05/2021)

✅ Fixing (06/2021 - 08/2021)

✅ Improving (09/2021 - 12/2021)

✅ Growing (01/2022 - 12/2022)

→ Roll up (1/2023 - ?)

Exit (? - 4/2023)

I’m suspending the roll up focus so I can give Reconcilely some attention in areas where seasonality may not be a factor (i.e. the new App Store has shuffled rankings and I may have to do a bunch of experimenting to re-earn them).

Fund Activity

Funds Deployed: $573.5k

Products: Reconcile.ly, Postcode Shipping

Closing MRR: $28k

30-day Revenue: $28.27k

Rolling cash-on-cash return: $476.14k (+83% / 0.83x)

30-day revenue growth: -$31.4k (-8.5%)

Current Total ARR: $335,500

Cumulative valuation increase: $936,640

Portfolio Valuation: $1,510,140 (+163.32% / 2.63x)

23-Month Total Return (MOIC): 246.34% / 3.46x

It’s been quite a lazy month all things considered.

But it felt good to decompress a little bit. I have better clarity now and enough motivation to see the rest of the journey through without feeling like I’m dragging myself to the finish line.

Both myself and Eric feel similarly as far as leaving meat on the bone goes. There’s much we didn’t get to get to, and in a way this feels like a dangerous fork in the road.

I don’t mind extending the fund lifetime because (1) these are my funds and (2) we’re playing with house chips at this point.

But this may not be a precedent I’d want to set for myself moving forward. The point of a plan is to follow it.

If you need to adjust, adjust. But if you need to adjust again, maybe you need a better plan to begin with.

That’s how I’m sort of feeling about it, though I recognize the purpose of this fund was to make my teeth and learn the lessons I need to learn.

Importantly, there’s a case to be made about opportunity and leverage cost.

The reason I’m doing a ~2 year lifetime is so I can stair step 5 times in a decade.

Five exits in a decade, compounding up in size each time, likely ends up in the type of destination I’d want to be ~8 years from now.

By delaying the second stair-step, I rob myself of leverage I could apply to move to the next stage.

So the comfort offered by the products we’ve invested so much time and energy into is a bit of a warning as far as sticking to the plan goes.

We can buy ourselves another quarter, maybe two at most. But then we’ve got to take our chips off the table and move to another table.

This is not so much from a flipper point of view at all as much it is about optimizing for the best next move as early and as quickly as possible, all the time, until you reach your destination.

Product

We took the time to deal with some technical debt that had been slowing down the application. We trimmed the database size by a very large margin by removing old data that could be fetched back from Shopify if the need ever arises.

Also, we completed a Database hosting migration away from IBM Compose (which is deprecating/closing in March 2023) over to Heroku, which the app also happens to be hosted.

That saved about $3,500/yr in database costs with the bonus of having both the app and database hosted in the same place.

Very happy with some new functionality we’re shipping which should positively impact upgrades in the short term.

Specifically, the feature offers multi-currency logic for Paypal orders which allows invoices to follow the exact currency of the order rather than being converted over to the merchant currency.

This kind of feature started recurring in customer support threads, and is a perfect example of only being able to discover new product opportunities if your line of communication with your customers is clean, clear and regular.

Before building the product, we researched and discovered at least 30 merchants who are likely to upgrade their account to access this new feature, be it due to reaching out for it directly or by exhibiting similar attributes as those who have reached out.

Once it’s live, we’ll create a campaign in January to launch this to the new customers and offer them a one-time offer to upgrade.

Elsewhere, QBO has eluded us for months, and I’m not happy about that.

It’s not rocket science — and it’s practically all done — yet priority has consistently been given to other things that either had to be fixed due to time-sensitive reasons or simply as a factor of not recognizing just how close the main large prize is.

For example, entering this month we chose to optimize for performance because a really large customer — larger than we’d ever seen — had signed up and made us reconsider whether our current dev ops would be able to deal with the volume implied by launching on QBO.

Either way, the obstacles are all gone and it looks like strides are being made towards the prize.

My focus is going to be shifting towards App Store Optimization for the next little bit. I’m not sure if changes to the app listing still reflect immediately; if not, it will impact the amount of tests I can conduct per day.

Fund

LP Fund is in a holding pattern at the moment considering both the time of year and the timing of the first fund.

One thing at a time, and easy does it at this critical juncture.

Most of the content for the LP package is planned out, but not produced. It’s probably going to be easier to do that once Fund 1 is closed and/or as we get a clearer idea of what asset we will be acquiring first, and using which vehicles.

So as not to string anybody along, the plan is simply to follow up once there is something to follow up with, and then to become more regular with communications from that point on as things oil up.

Please do feel free to get in touch if you want to chat/explore. I’m happy to bring you up to speed, give you a general idea of what we’re thinking and collect your feedback.

Like everything, this will be iterated upon until we’re ready to pull the trigger with the right people.

Lessons & Learnings

Not much could have gone different had I done things differently. Sometimes that’s the way it is, and the only option is to react and to make decisions that positively impact the future.

On our end, that means moving forward with MRR-producing features, while putting a special emphasis on App Store Optimization to curb the current trend and kickoff the new year with strong growth, at which point I’ll revisit the roll-up and make a decision from there.

In the meantime, I plan on flying out for a week for some quality time with family, but will be back with a vengeance at the end of the month.

For now, I invite you to join me in putting physical and mental health first, so you can maintain your energy and motivation and stay on-pace and consistent with your personal roadmap.

In the end, we’re wrapping up the Growth stage for MicroAngel Fund I posting approximately 3.5x in 2 years. Not the 4x I was hoping for when I moved the goal posts, but still an incredible journey and win as it relates to my original investment all the way back in February 2021.

In allowing myself to dream a little bit, I charted out the next 4 “stair-steps” over the next 8 years, assuming I continue doing exactly what I’m doing, just a little bigger each time.

I’m excluding cash-on-cash returns as I expect to continue using those mostly as personal income/dividend — at least until revenue volume makes it efficient not to take more.

If I continue on 2-year stints, the next decade (including the last 2 years) would look something like this:

Step 1: $575k → $1.5m (3.5x, -300k on exit to personal balances)

Step 2: $1.2m → $3.5m (3x, -600k on exit to personal balances)

Step 3: $2.9m → $8m (2.7x, -1.5m on exit to personal balances)

Step 4: $6.5m → $16m (2.5x, -3m on exit to personal balances)

Step 5: $13m → $30m (2.3x, close fund)

In that scope, I’d be squarely leaving the Micro-SaaS market if I follow the above roadmap, and odds are quite high there are teams involved in most of the following products I’d look to personally acquire and grow.

But that gives me a general idea of where I’d like to be 8-10 years from now assuming 4 more runs at the bat, with a slightly declining expectation for returns as I go to account for the size of the deals, and the type/risk of moves made in that timeline to achieve those numbers.

I also appreciate having a clear idea of how my own personal balances would grow every couple of years (without being overly or needlessly exposed to income taxes on either the personal or corporate side) while maintaining enough in the company to field strong offers and achieve my returns along the way.

I’m blessed to be on this journey, and I hope to continue inspiring you on yours through this newsletter.

For now though, please do accept my best wishes for a happy, healthy new year full of positive surprises, wealth and luck!

Until next time!