Analysis: Profitable B2B SaaS producing $42K ARR & $41K profit, asking $160K (3.85x)

Deal review & analysis

There’s a new deal on my watchlist, and it’s a great opportunity to kickoff my first public review & analysis.

My goal with these posts is to write my thinking directly into the editor as I analyze the deal.

That means I haven’t looked at it yet at the time I’m writing these words.

And of course, like most other posts in the newsletter, this is not prepared in advance. Pretty exciting :)

It also means I’m likely to update the post if new information is received from the seller or is made available on the listing.

If I made any mistakes in my calculations, please shout it out on Twitter or in the comments section at the bottom of the page.

Enjoy!

→ Find the listing on MicroAcquire

Overview

ARR: $42,000

TTM1 revenue: $43,331

TTM profit: $41,555

30-day Revenue: $3,320

30-day Profit: $3,172

ARPU: $8

Asking Price: $160,000

Asking Multiple: 3.85x on profit

The opportunity we’re reviewing is a portfolio of Shopify apps.

When the listing landed in my inbox, I jumped on it, because that’s my main focus, as both an investor and maker (I build Shopify apps).

The listing explains the portfolio is comprised of 3 apps that each offer some unique functionality and value proposition:

cart abandonment

search engine optimization

coupons and discounting

I’m interested in all of these areas, but I’m immediately curious about the nature of what’s for sale.

Three products are together producing the $42K ARR, and they’re all in super competitive categories which have seen a lot of shake-ups in the rankings over the years.

The products are listed as founded in 2012, and running virtually on auto-pilot. The seller shares that he spends almost no time on them and is selling due to a career change.

I have a suspicion the product revenue is declining over time, so let’s start by qualifying that.

Fundamentals

Some of the most important factors of growth and stability for a Shopify app include:

the number of active merchants using it,

the actual overall rating out of 5 stars,

the total number of reviews for the app, and

the number of reviews added every week (velocity)

There’s a feedback loop created from increasing any or all of these metrics in the form of organic uplift in the App Store rankings.

This exposes the application to more merchants as they can more easily find it, and results in a generally accelerated rate of growth for installs (and thus revenue).

Earning reviews on the App Store is a true grind.

Merchants shop when they install apps, so making the most out of every install, offering incredible support & asking for an honest review is paramount to earning public feedback and increasing rankings.

An app that’s been on the App Store since 2012 has one huge advantage: it’s been collecting reviews for a really long time.

There’s a strong chance the app is above the threshold of apps with review numbers so low that they cannot rank at all.

But if the app has been around for a long time, has many reviews and is only producing $42K, there’s a decent chance it’s because revenue is declining.

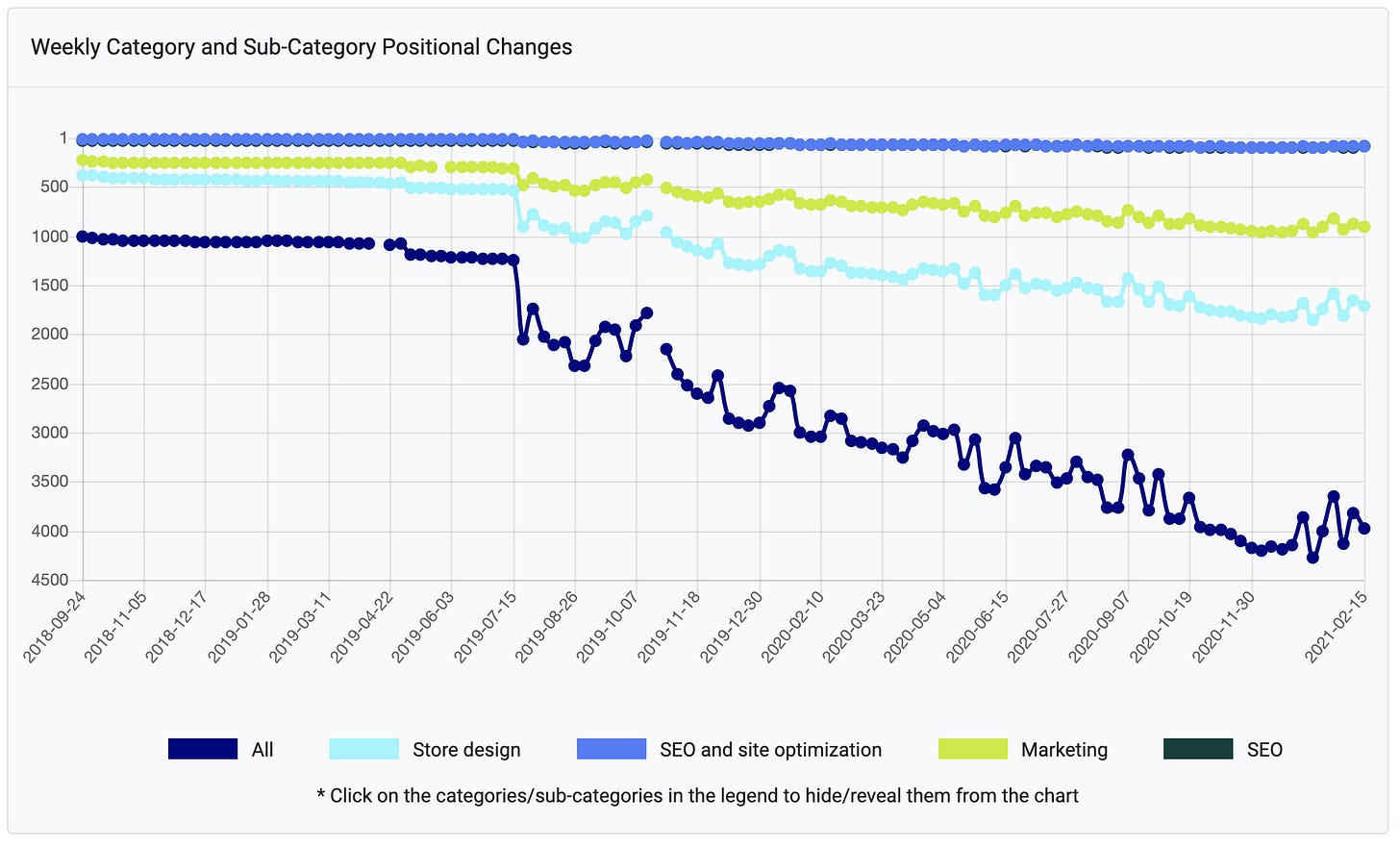

Since the health of a Shopify app is so intrinsically connected to reviews, I use the Shopify App Store Index tool by Union Works to chart the reviews of an app over time.

Let’s plug in the portfolio’s three apps:

Cart Abandonment Product

SEO Product

Discounting Product

Whatever happened in mid-July 2019, it decimated the apps’ rankings. On first glance, that’s going to scare off a lot of buyers. And that’s their loss. :)

Overnight, the three apps dropped from the 20th percentile down to the 50th, and have been steadily declining since.

Right now, it looks like the products have slid to the 80th app ranking percentile, which means there’s practically zero new user acquisition.

And that’s exposing the app to a pure-churn scenario: churning users at a natural rate without any users to replace them.

I can just about guarantee revenue is sliding, and that’s likely why these apps are up for sale right now.

…

After taking a look at some screenshots shared by the seller, I’ve confirmed that revenue is trending down linearly.

Revenue hit a high of 12.5K MRR in 2015 and maintained that position until mid-2017, when churn began to accelerate.

If I had to guess, it was an App Store algorithm update. I’m saying that because the rankings all cratered at the same time.

There’s also the fact that more complete solutions have been releasing in the time this product was built-and-held.

It’s a valuable lesson for my own activities:

I can buy-and-hold provided the products I choose are growing, but there’s a limited risk involved:

The products I buy are competing against many other similar ones, and a winning incumbent could change the economics of all of its competitors at a moments notice.

This is likely the most dangerous risk involved in the buy-and-hold portfolio style and I ought to problem-solve around this. Sticking only to Shopify may be too risky.

Revenue Trend

Revenue vs. 12 months ago: -25%

Revenue vs. 6 months ago: -9%

Revenue vs. 3 months ago: -7.5%

Revenue vs. 2 months ago: -6.25%

Revenue vs. 1 month ago: -4.5%

Risks & Opportunities

By far, the biggest risk in this deal is the speed at which it is shedding paying customers. Reversing this trend would require some really strong moves that jolt the paying users into retaining.

Considering the fact these products are extremely simple and bare, they’ll often be uninstalled in favour of more modern, complete apps that offer more value for the same money.

There is a very high risk of losing everything in this deal without a turnaround plan that yields strong improvements very quickly post-acquisition.

Based on my calculations, the Doomsday Clock for this portfolio is set to 24 months from now. It’s a net-zero event for these apps in 2 years unless something radical happens.

Without a doubt, the biggest advantage in acquiring something like this is the history behind the apps.

With 200+ reviews on the main app and 55 and 45 for the other two, what we have here is 3 starter-apps in their respective categories, with a super strong lead on the metric that matters most on the App Store.

Something old/veteran apps also often enjoy is highly unique and descriptive keywords present in the app URLs.

Coupling these two advantages creates a unique opportunity to continue building out these products and make them more complete, with a reasonable expectation that keyword rankings will begin to rise as a result of merchants staying on.

Return Range

Notwithstanding the strong likelihood of a net zero return, it’s possible to work out a return range for this product based on today’s revenues.

Considering the dire state of the products and the rapidly decaying revenues, I would likely move to offer no more than 0.5x were I to make an offer.

That’s a far cry from the 3.85x requested.

If I close at something like $30K, I’d secure approximately that much over the year despite the revenues declining. I’d then have that much time to deliver stronger versions of the product and make an attempt to reverse the trend.

If the cash-on-cash return for year 1 is 100%, this may actually be worth it simply on that basis. Anything coming in from year 2 would be additional, but that number would be smaller than year 1 considering revenue churn is so extreme.

If I fix the products and things do take off, these could become extremely strong assets.

In the pessimistic scenario, the products go to zero in 25 months.

In that time, I’d collect about $27k Y1 + $20.8K Y2 = ~$48k in cash from the products against my $30k offer. That’s assuming churn doesn’t accelerate even more.

I’d end up with a 0.6x multiple, and wouldn’t even return my money because the products would now be at zero revenues and effectively worthless +/- $1,000.

In the optimistic scenario, net MRR growth becomes positive as a result of working on the products. The trend is reversed and the apps join the 20th percentile of the app store.

Revenue starts to climb again at a similar rate as it did and revenue climbs to 25% YoY for 2 years. I’d collect $45k Y1 + $56k Y2 = $101 against my $30k offer. By EOY2 MRR would be about $4.6k

I’d end up with a 3x multiple on a cash-on-cash basis + unlock the ability to sell off the portfolios at a higher valuation than I bought it.

Today’s valuation if revenues were stable would make it possible to command a 3x multiple, working out to a $42k ARR * 3 = $126k price point. If I add that to the $101k I’d collect over the two years, that draws a potential total return of $227k vs. my $30k investment, a cool 7.5x.

This feels like proper angel territory: all or nothing, 8/10 write-off.

I estimate the odds of success for the optimistic scenario at 10% - 20% only. The pessimistic scenario is 80% likely to happen unless churn explodes even more.

Portfolio Fit

✅ Interest/expertise in the nature of the product

✅ Is the app history strong

✅ Is the tech stack manageable

✅ Is the support burden low

✅ Does the app have many (good) reviews

✅ Can this be a buy-and-hold

✅ Can this be a buy-and-grow

✅ Can I close a deal under a 3x multiple

✅ Is the potential cash on cash return 30% or greater

❌ Is it default alive

❌ Is it meaningful revenue

❌ Is churn under control (20% is just too much)

❌ Is the ARPU fairly strong (>$15) for Shopify

❌ Is technical debt under control

❌ Any feature/integration that could make MRR pop

❌ Is net negative churn possible

❌ Is app ranking stable

❌ Is the churn rate acceptable

❌ Is the expansion rate acceptable

❌ Does the expected monthly MRR growth match fund requirement

❔ Is the visit to install conversion rate healthy

❔ Is the the install to trial conversion rate healthy

❔ Is the trial to paid conversion rate healthy

❔ Does it have an expansion path

Total score: 9/24 (37%)

Current Decision

My analysis is incomplete. I still need to do a deep-dive into the current revenues, ARPU and see if there’s an upgrade path.

I also need to check what the marketing metrics are and whether there’s any hope to acquire customers through ads. The ARPU at $8 is going to make that really hard, but not impossible.

My initial reaction for this was to stay away because it goes completely against my thesis. I want simple products (check) with net MRR growth, however small that is (fail).

That said, the potential cash-on-cash returns, even in a Doomsday scenario where the products go to zero while I hold and milk them, would be quite strong provided the accepted offer is extremely low.

The sellers who list the products have built them over time and care about them, and I wouldn’t want to disrespect the seller by sending an offer they would find insulting.

I’m waiting on some payouts data from the seller to get a complete picture of what I’m playing with. That’ll determine if this is a buy-and-hold (or rather: buy-and-watch-die) or a buy-and-fix.

I’m not particularly interested in buy-and-fix, but considering the nature of the apps I’m working on as a full-time maker, there may be value in accessing the thousands of merchants using these apps while also potentially integrating my own product within and creating instant value.

I’m not sure about it, so I’ll let it simmer.

But for now, this is a pass.

Ideal Buyer

As you may have guessed, the ideal buyer is someone who’s going to want to actively work on the products.

This is a fantastic opportunity to do exactly that, provided you’re open to losing your entire investment if you fail to succeed with the turnaround campaign.

The tech stack is Node.js + MongoDB, pretty ubiquitous and straightforward to maintain.

If you’re interested in the deal, feel free to get in touch with me on Twitter and I’ll be happy to set up an introduction with the seller, send you all of my notes and any other relevant information.

Otherwise, you can check it out on MicroAcquire.

→ Find the listing on MicroAcquire

Have a great week!

If you find deal review & analysis posts like this one useful, consider subscribing to access more exclusive deep-dive content.

Trailing Twelve Months (TTM) aka last 12 months of actuals from today

The asking price for businesses on sites like Micro Acquire are crazy, considering that the majority of them have either no moat, negative growth, one source of traffic/revenue, or other skeletons in the closet. It's definitely a seller's market.