MicroAngel State of the Fund: August 2022

Pricing update oops, listing requirements, support tool consolidation & expansion mechanisms. Closing MRR: $27.76k

Good morning and evening to you friends!

Hope you had a great month. I’ve got a meaty one for ya today.

This monthly report finds you about a week late on the heels of my second daughter’s 1st birthday, labour day weekend and school adjustments over this past week.

Time with family is everything!

Month 19 has come and gone for the Fund I experiment, which aims to turn a $573k investment into $1.5m in total value.

So far, so great! The breakdown as of today goes as follows:

capital invested 19 months ago: $573.5k

cash returns collected over past 19 months: $356k

current cash-on-cash rate: 4.9% per month, 59% per year

minimum valuation: $1.33m

total value against invested capital: $1.7m

total multiple on invested capital: 2.89x

While I’ve reached the cashflow goal and am on-pace to reach the exit goal, I recently pushed back the liquidation month from February to April 2023 as I’m likely to fully pay off my original investment by that date.

It’s worth noting that I’ve been reinvesting a bunch of the free cashflows lately on non-renewable expenses that the new buyer wouldn’t need to shoulder. In this case, every dollar spent out of the cashflow aims to produce some additional MRR.

I’m not super happy with our product progress this past month, having sunk most of our time into support tooling migration and bug fixing.

Thankfully, investments from months prior bore fruit.

If your plan is to acquire a product that is default alive and to benefit from its free cashflows, it’s crucial to consider the impact of reinvesting those free cashflows during your investment’s lifetime.

With the new exit timeline extension, we’ve got 8 months to go in the fund. The reason I’m now reinvesting FCF is because we’re in the growth phase, the goal of which is to positively influence MRR in pursuit of the roll-up and exit phase.

It was a decent growth month as we finally bit the bullet and completed large projects we knew would have no bearing on growth.

Specifically, we shipped new listing changes to meet app store requirements and migrated both our products to a consolidated support platform (crisp.im) to the benefit of our support teams.

The n00b pricing mistake I made last month is finally out of sight, though it did artificially increase our churn threefold during last month.

What happened?

In manually cancelling faulty yearly subscriptions, we negatively affected churn and incurred immediate refund costs that we’ll only recover when those customers pay their Shopify bill.

Stupid mistake.

There’s been good progress overall — but not enough of it.

The velocity needs to accelerate and everyone’s on board with the why and how of that situation.

With out-of-scope activities out of the way, we can be more ruthless with respect to each next move so they help move things up and to the right.

I need more out of my teams now that individuals are focused on only one product each. Especially since I’m now spending most of my time in between growth experiments or completely out of scope, working on the DAO itself.

Speaking of the DAO, the Microangel community has been making incredible progress in pursuit of the DAO launch, which seems more clear than ever now that key decisions and individuals have been confirmed.

Current fund lifecycle stage

✅ Buying (02/2021 - 05/2021)

✅ Fixing (06/2021 - 08/2021)

✅ Improving (09/2021 - 12/2021)

→ Growing (01/2022 - 12/2022)

Roll up (1/2023)

Exit (2/2023 - 4/2023)

Fund Activity

Funds Deployed: $573.5k

Products: Reconcile.ly, Postcode Shipping

Closing MRR: $27.76k

MRR Growth: 3.48%

30-day Revenue: $28.08k

Rolling cash-on-cash return: $356.31k (+62% / +0.62x)

30-day ARR growth: $11.21k (3.48%)

Cumulative valuation increase: +$759.07k

Current Total ARR: $333,144

Minimum valuation (4x): $1,332,312 (+132.36% / +2.32x)

19-Month Total Return (MOIC): +194.49% / 2.94x

While the strategic decisions I’ve made are correct, and our products have improved greatly in the past year and a half, I currently feel a new sense of urgency regarding MRR growth, and am finding it progressively harder to justify expenses that don’t have a direct impact on revenue growth.

The impact needs to be more direct and clear moving forward.

Thankfully, expenses of this kind don’t carry over to the eventual buyer of the products, and the P&L will surely reflect that so as not to negatively impact the actual profitability of the products.

Discretionary spending like this will surely produce good results in the short- and mid-term, but I must admit I want to see more focus on growth and less on bug fixing or maintenance.

I’m just feeling more of a rush now since the purpose of the current phase is specifically to increase MRR, and thus far the additional discretionary spend hasn’t yet met my expectations.

With 4 full months left to the year, I’ve got full confidence in the folks who are currently contributing to the team and everyone is aware of the urgency I’m attempting to manufacture so we can become that much more intentional with each dollar spent.

Much of my jittery mood comes from the way the past month has gone.

It started with sickness, as my family and I spent a solid week and a half completely under the weather. Having a one year old coughing and sneezing in your face will do that to you.

Just perfect timing to be starting kindergarten and daycare, respectively. It was multiple kicks in the shin, one after the other.

Things took a turn for the worse: as the humans got better, my dog developed some kind of viral infection which culminated in intensive care for 3 days and a very scary experience for everyone involved.

Thankfully, everyone’s feeling better and the pup is on the mend, but not without the emotional, physical and financial drain implied from dealing with these situations.

With half the month effectively burned, I ended up spending most of my time working on the Microangel DAO now that resources and roadmaps are in place at Reconcilely and Postcode Shipping to produce continuous progress.

I’m not super satisfied with the progress through the month, but am cognizant of the why behind it, be it managing a large support platform migration (on both apps) through to the floods in Pakistan, affecting Zubair and his family.

While we’re in growth mode, I continue to be thankful for the work we get to do at the pace we choose to do it. Long-term moves can suddenly bear fruit on a month during which you’d expect a decrease in momentum.

People first. And one brick every day.

Reconcilely

Support Migration

By and large, my disappointment is unjustified. I’m not thrilled QBO is not live to the public yet, but it’s due to a decision I made at the beginning of the month, which is to prioritize the support tooling migration for both products.

That ended up being a huge project as we attempted (and failed) to accurately migrate previous conversation data from Helpscout and Intercom over to Crisp.

It ended up being a rabbit hole that wasn’t worth jumping into.

Thankfully, we’re done with that as the Crisp implementation is going live this week.

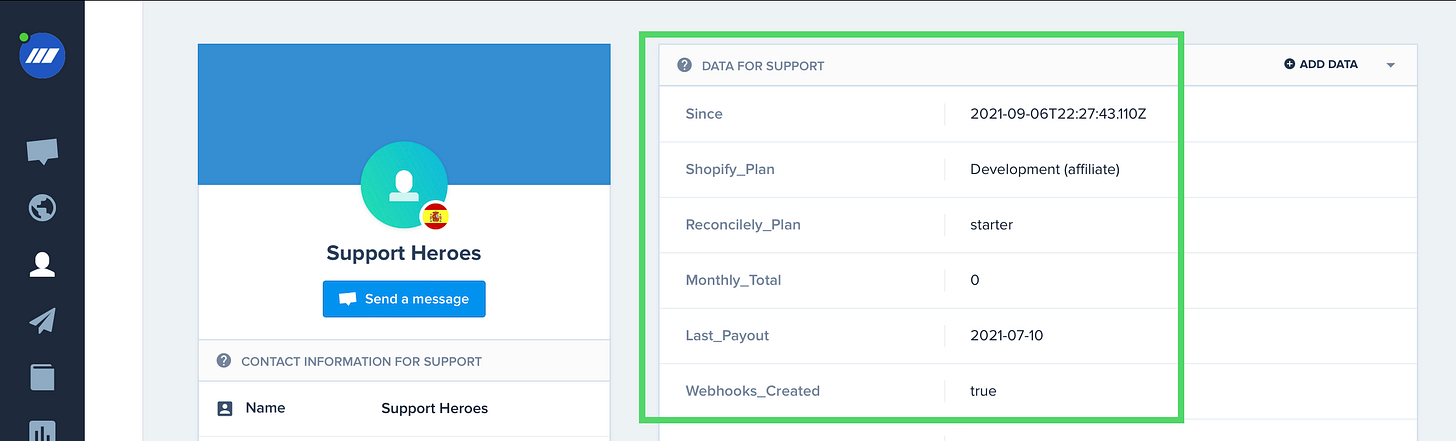

We spent the time to backfill the CRM for each of the apps with existing and past users, including data related to their user experience.

This allows us to power our marketing automation using Crisp moving forward.

This will also enable our support teams across products to live on a single tool and benefit from systems built for one product to deliver 5-star service to another with no additional energy or time spent.

App Store Requirements

We finished new app store listing requirements that were threatening the app’s ability to stay published on the App Store, and thus took precedence over everything else.

I’m just really over having to constantly push back my roadmaps to stay in the game, and in that regard, my appetite to keep working within the Shopify ecosystem is rapidly deteriorating, despite the incredible products we operate today.

Last month, I realized a mistake in the way we executed the pricing upgrade for Reconcilely.

Specifically, the mistake was using the REST API endpoints (as we have always) to create the new annual subscriptions.

Several customers signed up and paid for annual subscriptions, and it took me a solid 2 weeks to realize those new subscriptions were being created on a monthly frequency, instead of annual.

It turns out you can’t create yearly plans with the REST endpoints — only using the GraphQL endpoints. And that contains its own nuances.

I quickly took responsibility for this mistake and manual cancelled half a dozen subscriptions from these new customers, and issued immediate refunds to offset the costs they would incur on their upcoming Shopify bill.

The problem here is the way Shopify billing works means that customers who paid for the year (on a faulty $380/mo plan, for example) had already technically incurred the $380 cost, but it would be paid 30-45 days later along with their next Shopify bill.

However, refunds are immediately pulled from partner payouts and sent to the merchant. Which means we basically financed that refund up-front. Some of those payments haven’t even landed in our payouts yet.

Just a really stupid outcome from a small, but significant mistake.

Revenue Expansion

Following the increase of the pricing plans which grew our run rate from new customers, stage two of the campaign is to try converting some of the existing and past customers to upgrade to new plans and/or to come back to the app.

The general mechanism for converting existing customers to the new pricing is the following:

By default, all existing customers are grandfathered into their previous plan — nobody is forced into the new prices

If desired, the customer can retain the exact same features they’ve have at the exact same price, forever

If an existing customer wishes to access any of the new functionality we are releasing out of Beta, they’ll need the appropriate pricing plan that includes that feature

Should existing customers ever upgrade from their grandfathered plan, that plan will no longer be accessible

To reward customer loyalty for existing customer upgrades, all new pricing plans are offered at a 15% to 25% discount (forever).

i.e. $99/mo plan available for $74/mo or $749/yr

The upgrade discount will last for a limited time, after which it will no longer be redeemable.

This provides a fair platform from which customers who seek more advanced functionality (and whom are happy to pay for it) can access it while benefiting from an exclusive discount rewarding their loyalty.

Importantly, the pricing adjustments brought to Reconcilely were specific to its larger plans, which specifically provide functionality to larger stores whom, until recently, were receiving far more value than they were paying for.

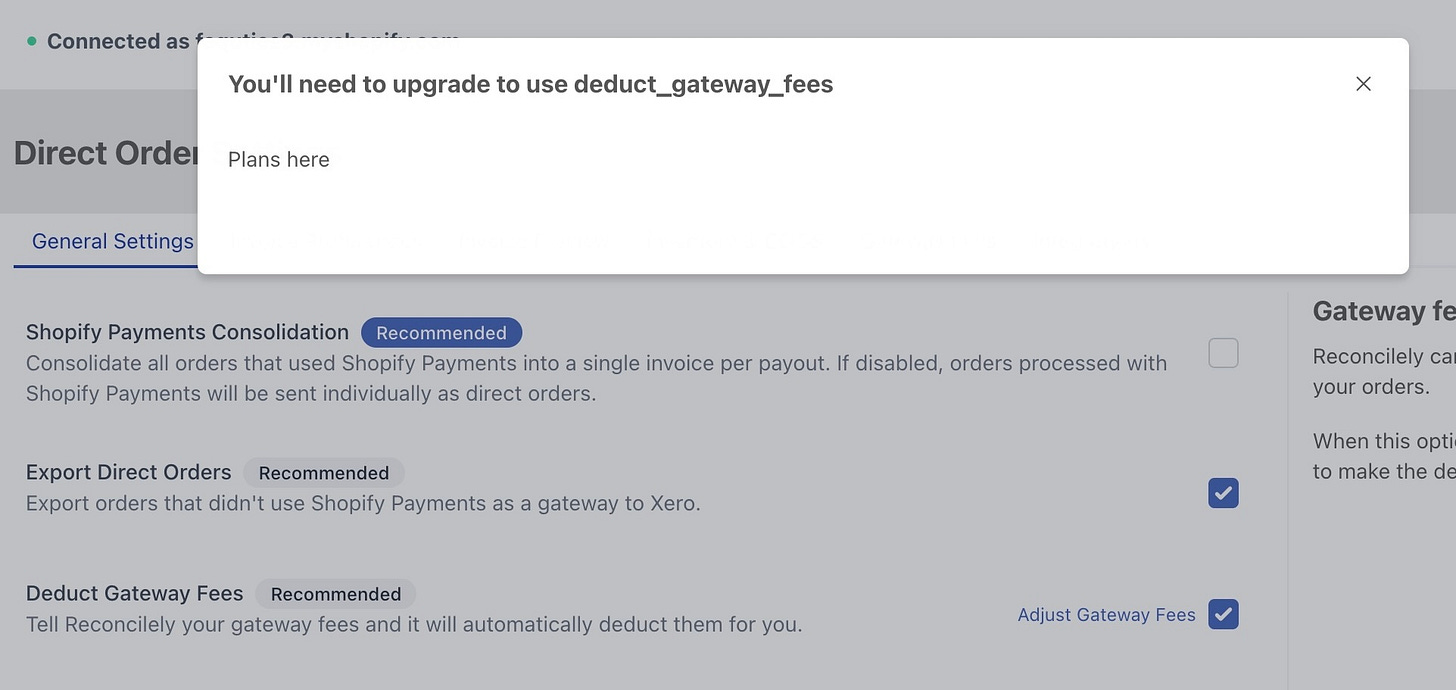

To power the expansion, I’ve been writing an improvement to the front-end which opens an ‘upgrade now to use feature x’ paywall if ever feature x is accessed without the appropriate plan to access it.

The modal will provide as options whatever plans include the feature the customer is trying to access, helping to instantly drive expansion based on a specific value-add, at the right time.

This will drive the revenue expansion we’ve been looking to kickoff so we can pay more attention to the mathematics opposing revenue expansion to revenue churn, and ensuring the former always outpaces the latter to deliver geometric growth.

High Touch Outbound

With renewed pricing that can deliver strong ACV’s, my hunger to drive qualified demos is greater than ever!

I’ve launched an initial experiment to drive conversations with merchants across the UK, New Zealand and Australia, whom are my primary target for the Xero revenue line.

This experiment, when made to succeed, will then be duplicated for the QBO revenue line targeting merchants across North America, hopefully in time for a QBO app store launch soon™️.

For now, my plan is to focus specifically on larger stores for whom my two largest plans are relevant and valuable.

Within demos, I’ll focus on driving yearly subscriptions by highlighting the savings implied by annual payments of a product which is set and forget.

This is additional to my ability to offer our trusty one-time promotional discount using our hidden pricing plans (i.e. $750/yr vs. $990/yr), should the situation ever call for it.

Provided I can fill ~4 hours per day worth of 30 minute demos, I should aim to conduct 6-8 demos per day, or 30-40 demos per week with qualified leads.

Considering 120-160 qualified demos per month…

So far, I’ve got an 87% closing rate on demos, which if slashed by 75% (considering outbound vs. inbound) should produce a customer about 20% of the time, or 1 in 5 demos.

At a 20% close rate, we should expect to earn 24 to 32 new customers per month from our outbound.

If we expect all closed customers to be on the cheaper end of the two annual plans ($490/yr vs. $990/yr) and that all sales are closed using the promotional plan ($390/yr vs. $490/yr), the low end qualified opportunity from this outbound channel at this scale is in the range of $390 * 24/32 customers = $9,360 to $12,480 ARR.

The higher end of the range implies closing all customers at the highest pricing tier, which would represent $990 * 24/32 = $23,760 to $31,680 ARR in mid-funnel opportunity.

I’d be more than happy to trade 4 hours per day to grow the product by an additional $9k-$31k ARR every month.

And it would be a strategy that we can reliably scale to other segments as we release new integrations.

Importantly, I may discover that demos are not necessary to drive conversion, or that similarly healthy numbers can be achieved with a greater top of the funnel (more leads) on a self-serve onboarding mechanism (instead of demos).

If my conversion rate on a message is 8% (instead of 20% on a demo), I could reach out to 3x more leads at the top of the funnel and reasonably expect similar results — without the additional costs implied by a demo or account executive hires.

Only time and data can tell.

Postcode Shipping

Despite the decrease in product momentum, it felt REALLY GOOD to be able to pull the same levers on both products at the same time.

Behavioural analytics

Since we needed to move Postcode away from Helpscout towards Crisp, it made sense to take a quick detour and implement Segment to the app for the first time, and to power Crisp through Segment.

That provides extensibility in case we want to start using other tools, without having to re-integrate the code. Now, the events can simply stream in to whatever part of the stack is needed.

Yearly plan

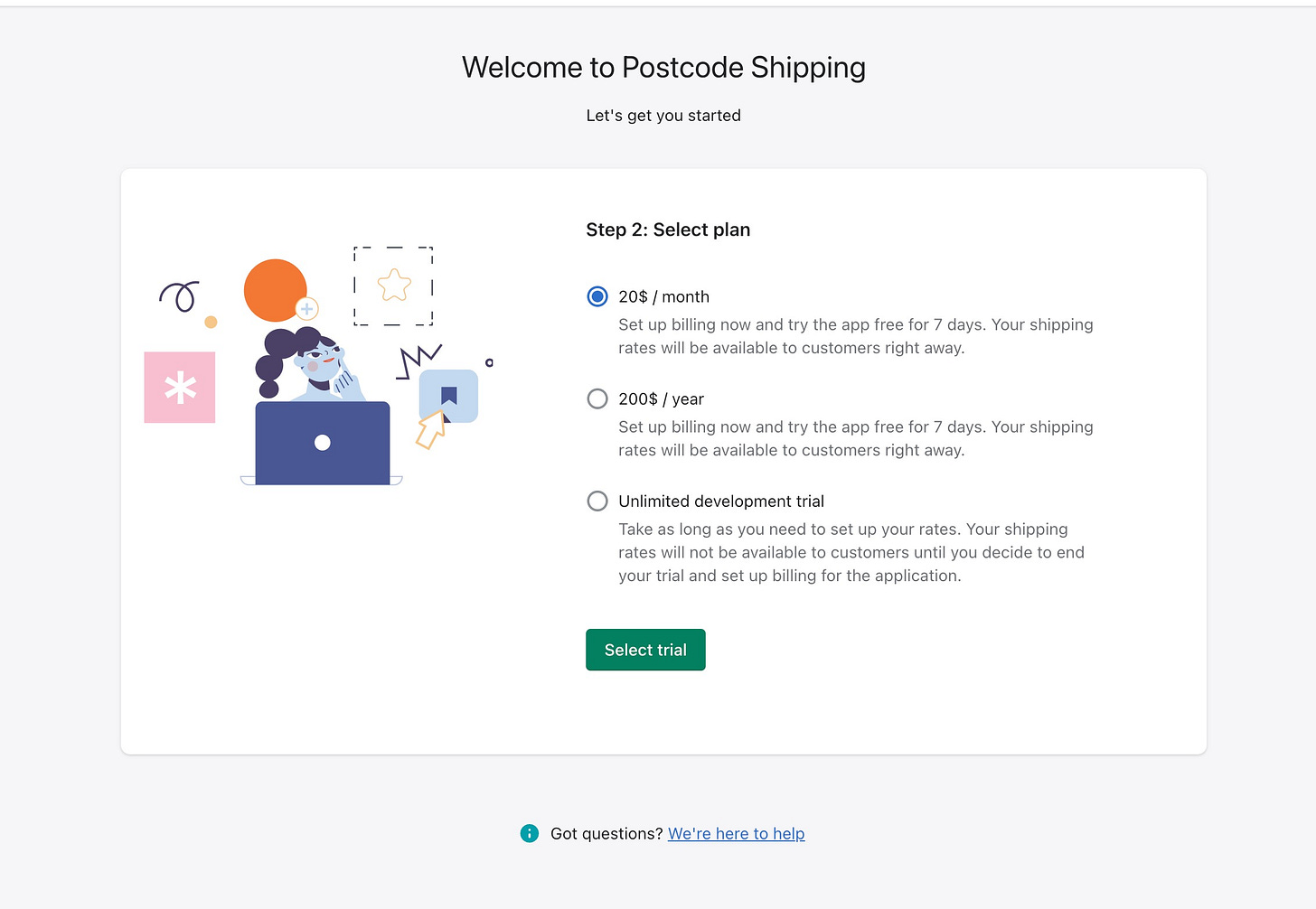

This feels obvious now, but Postcode only has a $20/mo plan right now. A lot of customers, new and existing, may prefer to save a little on cost by paying for a year (or two) up-front.

For that reason, we’re releasing a yearly and biyearly plan available at $200 every year and $349 every 2 years.

I’ll start with the yearly plan and measure the impact before introducing the second yearly variant.

This will likely drive a similar uptick in cashflow and retention as we have seen on Reconcilely. By experience, I’ve always expected annuals to uplift by about 10-11%, and that’s been the case for Reconcilely as well.

A 10% increase in cashflow at the moment would drive an additional $1,900 to $2,000 per month in collected revenue (from annuals).

Very much worth it!

Automated messaging campaigns via Crisp

With Crisp integrated, we’re going to kickoff a wide variety of messaging campaigns, both automated and otherwise, to drive onboarding installs, trial conversion, revenue expansion, app cross-selling and customer winbacks, among others.

Since we’re moving Reconcilely away from Intercom, I’ll also have to bite the bullet and set up everything there too, which is a good opportunity to start with a clean slate and try to leverage the updated value props of each product to effectively drive messaging and conversion in the right segments.

Growth plan: Add Free & $49 pricing tiers

With Zubair, my main goal is twofold:

Model the cost of a free plan and the expected conversion path from free to paid considering we already offer an unlimited trial option

Ship high demand features requested from larger stores to be able to introduce a new $49 plan including those game-changing features

Achieving both of those goals will require some upfront research, customer interviews and of course data (which now pipes through to Segment) to better understand how customers will react and are reacting to changes brought to the product.

As with Reconcilely, we’ll release stuff to production in stealth with an allow list of merchants we manually port users to as they request for features.

Once features are good to go, and we have enough of them to justify a new pricing plan, we’ll kickoff that phase.

Microangel DAO

I’m excited to say that momentum has exploded over the past few weeks. From new team members to building in public to sneak peeks of the Microangel NFT, things have really started coming together.

Twitter Spaces

Probably the best way to stay up to date with DAO related stuff is to keep in touch with the @microangeldao Twitter account.

In the past month, DAO hangouts moved out of the Discord and into Twitter as a way of perpetuating this culture of building and investing in public.

To that end, I would recommend you give the two Twitter Spaces a listen, as they contained curious and exciting conversations surrounding the DAO, some of which I will list below for you.

These Twitter Spaces run like a podcast, which is interesting because I considered putting the audio up on the newsletter directly. I think I may do that and see how that goes, so keep an eye on your inbox.

In no specific order, here’s a shortlist of activities and milestones the DAO community managed to achieve past month:

Bucket Auction Segments & Value Props

Bucket Auction Unit Economics

Pro Forma Budget per $MM AUM

New Team Members

First Acquisition Parameters

On-chain Governance Prototype

Dealflow Kicked Off

Powering the core team with FTEs vs. contractors vs. agencies

Legal & Howey Test

Long term DAO Fund Strategy (MicroAngel/Constellation Software)

NFT Sneak Peek & Trait Strategy

Let me know if you’d like dedicated updates for the DAO, as the updates above are worth their own post!

It’s been awesome!

It’s clear that the interest and excitement isn’t specifically in the idea of an NFT, but in how a community is coming together to operate this type of organization, and the velocity we can reach when decentralizing decision making and value generation.

Here’s that sneak peek of the MicroAngel NFT concepts.

Which style do you prefer?

Lessons & Learnings

We are past learning, we are focused on doing.

I’m taking whatever mistakes I make in stride so as not to lose momentum with the other things that I do right.

With the focus on growth, nothing else matters in our decision making. There’s a ruthless objectivity to the types of things we ought to be doing, and delicious clarity with respect to how those things come together.

Though I wasn’t thrilled with product progress this month, everything else has been successful with meaningful progress across the board.

What can I improve?

It’s been awhile since I’ve openly asked for feedback to improve the newlsetter. I hope the new format of delivering one report per month hasn’t disappointed you too much.

There is an immense opportunity to communicate progress related to the DAO, but that’s not necessarily what you signed up for when this newsletter caught your eye.

I’d be curious to learn more about your own goals and what matters to you, so I can figure out if there’s a way to meet you halfway through this newsletter.

As always, thank you so much for following along. If you’re looking to get involved in any way, follow @eyaltoledano on Twitter to get in touch or join us in Discord to help us build the first decentralized PE fund.

Till next time!

What is the make up of your team? It seems like a lot is being done, so I doubt it's only you :-)