MicroAngel State of the Fund: June 2021

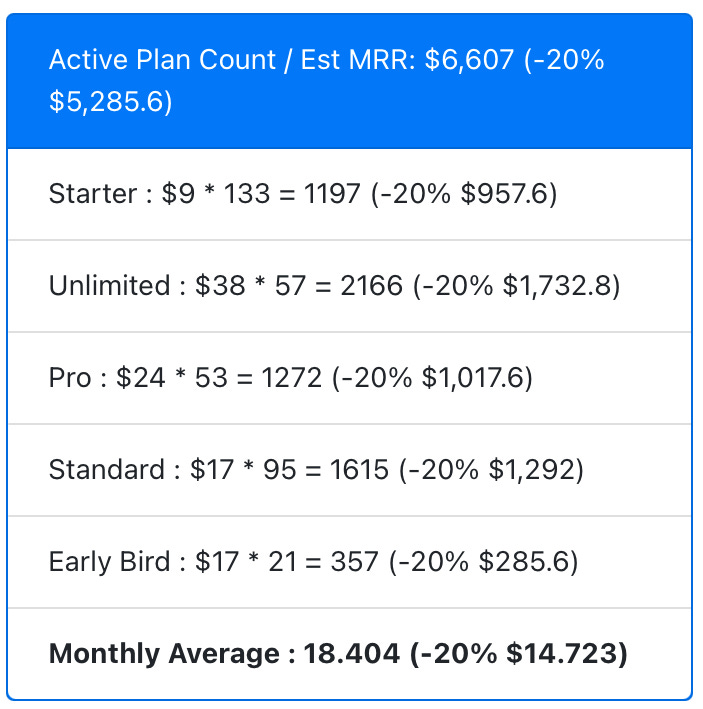

Dissolved + new deals, revenue milestones, challenges bootstrapping Batch. Closing MRR: $5.28k / $15k (35% to goal)

Holy shit! I’m already through 25% of MicroAngel fund I!

Time flies!

You know what didn’t fly? The month of June. 😂

Unlike most months, June turned out to be one of my least active months so far, and that’s saying a lot considering I’m in Miami right now recharging my batteries for another week.

First, our house move finally happened and took most of our time + energy. A week later, we were on a plane to Florida for some R&R.

Secondly, what seemed like a closed deal finally dissolved into a false promise after a seller failed to sign an APA on 3 separate occasions (details below).

This inevitably thrust me back into Buying mode despite being very late with my buying schedule.

It’s been a tough break in that regard, where my investment focus ended up hampering core activities, which should have transitioned fully to Fixing.

Not worth any stress whatsoever, things simply are going the way they always would have.

Thankfully, I did spend some time reviewing and executing against my Reconcilely roadmap and getting much more intimate with the code base as I released several small fixes to improve onboarding.

We’ll see over the next few weeks if those changes had any positive effect.

I also started laying the foundation for a repeatable growth experimentation process. All in all, I’m only through maybe 15% of my tasks for Fixing so far.

Though things are certainly looking up on the Buying side despite some setbacks in the first half of the month, I must admit I’m starting to feel like 0.7x is going to be a big challenge…

…Unless I can complete a transaction with an attractive MRR and revenue multiple to offset my tardiness and resulting unperceived revenues…

…This month! 😬

I’m affording myself the rest of July to finalize that transaction, which (thank God) is on-pace, though this means my focus is still very much split in two for the time being.

By far the biggest risk to the fund has been my inability to close a deal on-time within my aggressive acquisition parameters. If you ever plan on doing this stuff, this is the number 1 thing to somehow de-risk.

Considering my priorities are to start adding value to the product(s) I’ve acquired as soon as possible, I gotta say I’m feeling the rush starting to building up.

I don’t hate investing but I much prefer building and marketing, and, well, I wish I could do just that all day!

That said, things have continued to tick along in the best way possible as we completed our move to our new home.

While it wasn’t our first move, it was definitely our biggest one yet, with dogs and kids to lug around, it was a heck a time. Glad it’s done tbh. Now I can finally look beyond this milestone.

Current fund lifecycle stage

✅ Buying (02/2021 - 05/2021)

→ Fixing (06/2021 - 08/2021)

Improving (09/2021 - 12/2021)

Growing (01/2022 - 08/2022)

Roll up (09/2022)

Exit (10/2022 - 12/2022)

Currently, I’m focused above all else on finalizing a transaction that can solve for Fund I’s MRR goal (15k+) and with potential to produce a 2x return within the next 18 months.

Tough? Sure. Impossible? Deeeeeeefinitely not. It’s VERY possible.

I’m pretty convinced my luck has been shittier than my process has been. I have seen hundreds of deals at this point. I could have pulled the trigger on so many, but discipline is the name of the game.

I’ve learned so much over the last few months between the hundreds of conversations with sellers, losing deals due to low offers or outright being ghosted at the 11th hour by a seller.

It soooort of makes sense though and here’s why:

Amidst the slew of fund activities prepared for myself between February 2021 and February 2023, investing is the one thing I had the least experience with going into this journey.

That’s what excites me most about this journey. I’m finally learning again, and staying humble in the face of new experience.

The idea was to develop those skills and I’m confident I have, in so many more ways than one. I’ve become passionate about microacquisitions beyond my own work. I believe they hold the key to the future of entrepreneurship.

I’m learning a lot, meeting a huge number of you and really enjoying the process in the mean time. It’s definitely the climb, otherwise I’d have stopped trying to do this months ago.

Every day is a joy despite often jumping out of the cookie cutter I’ve prepared. As german field Marshall Helmuth von Multke said, the plan never survives first contact with the enemy.

What’s refreshing is that the time I’ve claimed back for myself affords the flexibility required to adjust and adapt.

My schedule is often violated either by luck or otherwise, but all in all, I’m convinced that 6 months ago, I made the best possible decision for myself. It’s been a whole lot of fun so far!

Importantly, I’m not out of time by any stretch of imagination.

I have plenty time, though I often choose to invest it in places that need active participation moreso than the product(s) I’ve acquired — which, really, is a quality of those products moreso than an illustration of a lack of time.

I’m currently taking a much needed family vacation to recharge my batteries and get ready for Baby #2 in September.

That is an example of time shortening, where the window for things that absolutely must be done is closing vis-a-vis the arrival of a child that is sure to shuffle my life cards once more (in the best way possible).

In other news, I’m really excited by Shopify’s latest announcements, the benefits of which will take effect as of August 1st (next month) and representing a 25% increase in MRR for Shopify apps producing under $1M in annual revenue.

While I’ve mostly been spending time understanding and preparing to refactor some of the Reconcilely code, I’ve also had to kickoff new conversations with sellers.

I have been very blessed by the wave of inbound interest from sellers interested to sell their products to MicroAngel, and the ensuing conversations that have taken place in the second half of the month.

If you’re reading, thank you 500,000 times!

June 1st deal dissolved

As I hinted on Twitter, the first half of the month was marked by the dissolution of a transaction that, for all intents and purposes, was set to close on June 1st.

The way the deal died, I must admit, was incredibly confusing.

Here’s what happened:

Sometime in May, I received an inbound request for offer by an individual over Twitter DMs.1

The individual in question, which we’ll call M, approached me about a SaaS product they and their cofounder had built over the past year and a half in a category outside of the Shopify ecosystem.

The basic premise of the product was strong, and it produced valuable insights for the few dozen customers that were subscribed to the product’s subscription plans, the aggregate of which produced ARPUs in the near-mid 3 digits, a highly attractive quality.

High ARPUs are great because they enable you to reach your MRR goals faster with less customers. In that regard, the product was regularly attracting new MRR in excess of +$1k per month, but subsequently lost it all to churning customers.

Revenue had reached a plateau that the seller felt incapable of solving due to their focus on the 0 to 1 process, and their self-proclaimed focus on building products, rather than building systems to expand the growth potential beyond the $10k MRR mark.

In short, the LTV was getting in the way of the product’s growth, as it was unable to retain the customers it (barely worked) to acquire, and thus represented a good opportunity for fixing and improving the product’s onboarding and PLG playbook to good effect.

Secondly, the seller expressly defined an offer range that they were looking for, which effectively worked out to a multiple at or under 2x, which further drove my interest to explore the opportunity.

Importantly, the MRR was close to $10k, which represents a special opportunity for the MicroAngel fund as I seek to fill about that much in my quest for cash-on-cash returns over the next 18+ months.

Finally, the nature of the product was reasonably simple.

It did one main thing, decently well and with decent consistency. There was certainly something to it, and I could see myself improving and developing upon that original foundation.

For those reasons and more, I decided to meet and greet the seller and go over the product, its future and what a transaction might feasibly look like for us.

Very quickly, I was pleasantly surprised by M’s level of commitment to provide relevant information about the deal.

Indeed, M openly explained that they were a newsletter subscriber and that the nature of investing in public made it clear to them what kind of criteria I based myself on.

M’s opening statements on Twitter DM’s mentioned that the product was a great fit for the fund on the basis of the grading scale I tend to use to quickly assess opportunities.

And M was right.

I quickly got excited by the product and began investing in my relationship with M, who reciprocated with great energy and determination to come up with something that worked for the both of us.

In fact, during our first call, I discovered in M an individual that I could see myself working with in the long-term.

Something that’s important to me is continuity and knowledge transfer beyond the training period.

You see, creating a product is the ultimate commitment to materialize something out of a number of insights you have about a given category or workflow.

As an external party/acquirer, I don’t necessarily have those insights as my day-to-day hasn’t driven me to discover them, which is extremely significant considering the future of the product would be tightly intertwined with the need to leverage those insights to create more value for customers.

In short, nobody but the original founder really truly gets it, and there exists a non-zero chance that an acquirer will never manage to reach those insights on their own, which increases the value of long-term relationships with sellers beyond training.

M and I found that we enjoyed speaking with each other and saw eye-to-eye on many things from product development to the potential of the product beyond its current state.

I had a vested interest to involve M in the product beyond the transaction itself, and came up with a mechanism to maintain a long-term relationship with M beyond the deal, as a long-term advisor.

Such an advisory gig would come in handy moving forward as I could reasonably draw insights from the seller at a few moments’ notice, without creating any misalignment as it relates to the M’s interest in maintaining a long-term relationship with no prospect for additional value transfer beyond the sale itself.

That’s why my offer included a liquidation participation which basically affords the seller a percentage of future proceeds created by liquidating the asset in the future.

In short, it was a way to compensate the seller’s continued involvement by sharing with them a piece of future proceeds created by selling off the product myself to a future acquirer.

It was as radical as it was innovative, because it created instant alignment with M to stick together as a pseudo-team which cares about the future of the product and its eventual future selling price.

An LOI was signed and a date for asset transfer set to June 1st 2021, which represented the symbolical limit of the first fund’s buying journey, and an ideal cut-off point from which to start fixing and improving both Reconcilely and this product.

As I walked through due diligence with M and their cofounder, it became clear that a few things needed to be solved prior to a transaction being possible.

I’m talking about product-level work that I wasn’t about to take on myself relative the purchasing price.

But the scope of that work was large enough (10+ tasks worth 3+ months of work) that I decided to decouple it from the product transaction itself.

We eventually agreed on a purchase price for the product itself, and defined an attached freelance contract worth $20k to produce the work implied to fix the product and get it in a place that was ready for operations.

I’m talking things like Stripe billing improvements, SEO fixes, the creation of a back-office to manipulate DB entries and anything in between that could hamper the progress of the product or the delivery of support for me moving forward.

It made sense, we agreed, and included the task list as an Annex item at the end of the APA document.

So far, so good. M had been a perfectly straight shooter.

There had been no surprises and/or random events that could hint to what was going to happen next.

I finalized the asset purchase agreement and set the closing date to June 1st, which would trigger an all-cash transaction in excess of $200,000 on closing, as well as the start of the freelance contract that would go on for approximately 90 days.

The value of the freelance contract was in direct correlation with the number of tasks completed by a specific cut-off date, as I had no interest in waiting ad vitam eternam for them to complete work required for me to kickoff operations.

The last thing I wanted was to have a closed transaction only for the sellers to back away from the freelance work required.

Closing day came around on June 1st and… nothing.

No signature. No email. No response. Silence.

I don’t usually stress too much about dates on contracts provided you and I are in constant communication about what is going to happen and when and this deal was no different.

The next day, I received an email from the seller exclaiming that the week had gotten ahead of them, and that somehow the closing date had been missed due to an honest time-management mistake.

Pretty weird. But no sweat. We all make mistakes.

I got in touch with my lawyer and requested a new copy of the APA set for June 7th, to give plenty of time between the now-past original date and the new closing date to align any ducks that had gotten in the way the first time around.

Guess what?

June 7th came around and nothing happened.

That’s when yellow flags went up.

At this point, I should have rescinded my offer and withdrawn from the deal.

This was my mistake.

I called M, who had been texting with me regularly throughout the week, to get an explanation for why the APA hadn’t been signed despite us specifically defining the 7th as the new closing date.

To my confusion, M explained that he was out of town to celebrate their significant other’s scholastic success and graduation. And that, if I didn’t mind, it would be cool to do this on the 14th.

I was completely dumbfounded.

Surely, this was a joke, I thought to myself.

Surely, this person realized that this behaviour is the complete opposite of what I was expecting as a buyer.

I made them understand that I was deeply disappointed by this news and that, quite frankly, I was thinking of withdrawing from the transaction on the basis that I could no longer trust their word.

In fact, I made the express explanation that the reason an APA exists and is used is so that each others’ word isn’t required to guarantee a smooth transaction.

In other words, they had sacrificed whatever good will they had earned through the month and had lost my trust as a buyer, which itself should have been more than enough to exit the deal.

Instead, I made the mistake to give additional leeway as a justification for the time and energy I had already invested into the deal.

Because all things pointed to a close on June 1st (and then June 7th), I had stopped any and all lead generation as it relates to new deals over the month of May, and was fully focused on the deal at hand and the eventual process of kicking off operations.

Annoyed, I explained to M that June 14th was the final date change.

It was set for a Monday, so I made sure to call M on the Friday prior to guarantee that everything was in-line, and that nothing was going to get in the way of a signature and closing date the following Monday. Everything was good to go.

Spoiler alert: they didn’t sign on June 14th.

At this point, I was already out.

M didn’t bother to reply to my texts for 2 days due to “being at the vet,” so I dispatched an official letter to both sellers letting them know I was out.

In their near-immediate reply, M explained that they had finally decided not to sell because they hadn’t played all of their cards.

They felt like there was more they could do to push the product to the next level, and hoped they could revisit the transaction with me in 2-3 months.

Just… no.

I felt pretty insulted, and considered sending them an invoice for growth consulting services relative to the work I had cut out for them to complete as a result of the transaction taking place.

All pointed to them realizing how much potential was still left in the product, and a disconnection from our original agreement in the hopes of being able to execute upon those tasks on their own.

In the end, I made a human error created by human emotion.

I mistakenly gave the benefit of the doubt twice to an individual who all but deserved it, and was burned for it.

But… in retrospect, I’m happy I didn’t complete the transaction.

This is the opposite of the type of person I want to do business with. I’ve burned bridges for less. Thanks, but noooooo thanks.

There are a few lessons to unpack, but by and large I’ve mostly determined not to give an inch of trust to sellers moving forward.

A human approach is key to creating relationships that lead to transactions. It’s the foundation of good acquisitions.

You can only be so transactional about a microacquisition considering you are purchasing a whole product that currently relies on the insights and actions of one or two individuals.

It’s up to you (and me) to determine a path that can achieve that level of relationship within a tightly and well-defined area of operations that, if violated, immediately would lead to a dissolution of the deal.

I’m much more up front about those things today and they’ve been coming in handy within the framework of the conversations I’ve been having over the second half of the month as I attempt to close another deal.

It’s a hard lesson, but not one I’ll have to learn ever again!

Fund Activity

Funds Deployed: $148.5k (29.7% of funds)

Products: Reconcile.ly

Current MRR: $5.28k (35% to goal)

MRR Growth: +5.6%

30-day Revenue: $5.4k

Rolling cash-on-cash return: $25.56k (17.2%)

Cumulative ARR growth: +$3.37k (+8.4%)

Cumulative valuation increase: +$19.78k (+8.4%)

Current Total ARR: $63,180

Fund valuation @ 4x: $252,720 (+70% / +0.70x)

6-Month Return (MOIC): 87.2% / 1.87x

Headlines

Conducted 9 Zoom calls with sellers

Spoke to 6 unique sellers

Signed 5 NDAs

Submitted 2 LOIs so far, 1 accepted

Withdrew from 4 deals in due diligence

Sending an APA today!

Current Deal Flow

Open Conversations: 2

LOIs submitted: 2

LOIs accepted: 1

In diligence: 1

APAs signed: 0

Portfolio Activity

Reconcilely

Like clockwork, Reconcilely has continued to tick along, this month registering expected MRR growth reaching $5.28k, up from about $4.9k last month.

I’m also celebrating an awesome milestone, as Reconcilely hits 400 active merchants for the first time. As a matter of reference, Reconcilely had approximately 325 merchants back in February when I acquired it!

You can tell that there still are important elements getting in the way of retention and that’s what I’m pretty much focused on for the next little while.

I’m looking forward to several new trials converting this month, furthering the stable MRR growth that now characterizes this fantastic product I’m so excited to continue improving upon.

As I’ve continued to organize the roadmap, it’s become clear that a lot of the work cut out for myself beyond growth marketing is actually quite technical.

I’ve got a decent handle on the code base at this point, but I’m not a professional developer by any means. The missing pieces are quite large and involved.

There’s still a lot I need to pick up and learn (or re-learn) before I can start writing the new pieces of software that I need to.

As previously explored, Reconcilely is a massive horizontal and vertical opportunity, and I would love to figure out how to expand the consolidation tech that it is built upon so it can work with any payment gateway rather than releasing new integrations one at a time.

I feel a little behind on the Xero development side as I usually fall-back to my wife’s knowledge as a source of information for all things related to that software.

But if I’m going to expand Reconcilely, then I need to become a Xero (and QBO) pro, which is something I never thought I’d ever have to do.

Which leads to the question of hiring.

With the small unlock in new MRR coming next month, and the continued progress with new deals, there’s a pretty strong chance I’ll be posting MRR above $15k and have enough space leftover to bring on a teammate to help me expand upon Reconcilely and others.

Specifically, I kind of feel like I should be bringing on a mentor/engineer hybrid so I can continue to expand my own skills, which I have a vested interest in developing, while ensuring the most difficult infrastructure questions can be handled by someone better equipped than myself to answer them.

It’s been a lot of fun actually developing my understanding of the product as it starts to truly feel like my own.

There are certainly many things that could be better, including code quality and design, but it’s still miles ahead of what I could produce in the time the seller has produced it.

That’s the power of the founder’s insights. They beget speed.

And in that regard, I believe having a battle-proven and thoroughly-tested code base is a luxury in of itself, as any changes I make will reasonably be guarded by the lines in the sand that the unit and regression tests represent.

On the marketing side, customer acquisition via Shopify ads have been only producing a ~50% ROI and I’ve confirmed I will have to start transitioning to other RTB platforms now, and with tracking being a little more challenging, that’s gonna be a fun exercise.

New install velocity is up slightly as a result of listing Reconcilely across all of Xero’s app marketplaces, and I expect that to persist and increase as reviews on those app stores are earned and increased.

Lastly, I received two offers this month to sell Reconcilely for proceeds in excess of $300k, which basically means a 2x return from selling it is just about guaranteed a year and a half from now.

All systems green here! Gotta keep jogging forward.

Batch

Ah, the dark side of bootstrapping.

Things have slowed down considerably at Batch over the past two months as a result of our hard-headed bootstrap approach.

Installs are simply not accelerating despite the changes we make to the app listing but the number of experiments we conduct is not anywhere close to where it needs to be.

The app doesn’t seem to fit properly anywhere on the app store, despite providing a 5 star experience when it does manage to capture the attention of a merchant.

Shopify ads are out of the question — they’re not just expensive. They are a reflection of the greater keyword demand on the network. It’s like amplifying the existing problem & burning money on top of it.

This is deeply frustrating for the team because we know the power of the Shopify ecosystem is real. I feel it every day looking at Reconcilely — it just ticks along without intense rankings.

Every app needs to make its niche, and Batch has so far been incapable of doing that due to a value proposition that sits slightly outside of the categories offered by the app store.

Where the app certainly does help with cart abandonment, it is not a through-and-through cart abandonment app.

Where the app is a radical improvement on cart conversion, it isn’t a pure conversion optimization app either.

These oddities cause the app to lag behind other applications that either have ultra-defensible rankings (and a high number of reviews to cement those rankings) or which represent more purist solutions within those categories.

And that means installs are nearly impossible to come by, never mind acceleration. Whatever we do rank for is all but irrelevant, and unless we make a massive shift in messaging, this is unlikely to ever change.

What’s tough about that realization is that, despite pivots being in the nature of early startups, they have a real opportunity, energy and time cost — which are considerable in a bootstrapped & part-time context.

Because my cofounder and I (mistakenly) chose not to raise any funds, it became clear the side project is going to stay a side project for the foreseeable future.

There isn’t a ton to double-down on. It’s producing, but not enough to sustain the team. It still feels like a ground-level opportunity.

Which suuuuuuuuuuucks.

The product is simply too ambitious for the amount of time that we dedicate to it, and that reality is preventing us from progressing.

On my end, I can’t justify spending any more time on a project that I alone am contributing to regardless of how life is looking on the outside.

Motivation and energy are a zero-sum game, and I’m nearly all out of gas there trying to produce movement out of the existing means we have at our disposal. It feels a lot like beating a dead horse.

Something radical needs to change for motivation to kickoff again so we can justify another go at market/product-fit, which so far has been very challenging, though really unstructured.

Until full-time can be dedicated to the project by the entire team, it is stuck as a side-project and that’s not something that can change simply as a matter of decision.

There’s a reason I decided to start the MicroAngel project — so I could reclaim the day and route my energies into things that require that full-time (while being able to Hold on to microSaaS products that don’t eat up much of that time). That included Batch.

Part of going all-in on the MicroAngel journey was to afford myself the time and energy required to take Batch to the next level.

Unfortunately, not everyone in the team can afford to spend FT on it, which brings me back to the issue of raising funds.

I should have seen that coming.

I have a lot of trouble justifying selling equity to reach market/product-fit, nevermind being able to spend FT on a project. But I realize that I made a grave error resisting that temptation, for it is unequivocally paralyzing.

By and large, I believe unlocking FT bootstrapping work is a problem for each individual to figure out. Otherwise, you have to raise funds. There are no other ways around it.

You ought to build your own financial moat and solve your own challenges before trying to tackle problems for the world. Sometimes, hands can be tied, and the game can feel impossible.

In that optic, I decided to make some changes to our DNA by accepting first and foremost that our circumstances had changed enough to create a burden that couldn’t be shared among just us two anymore.

At least not within the current context of the project’s team.

At this point, I must accept that a bootstrapped context will lead nowhere under the current variables.

Because the proof of concept was so successful, neither of us want to shutter or sell the project — quite the opposite!

So, what do we do? I can’t stand the idea of making excuses.

There are no excuses to explain a lack of execution.

It’s you and your laptop. Go and make it happen.

If you can’t produce for whatever reason, it’s either because I haven’t done my job removing roadblocks for the team, or the roadblocks are personal. In the latter case, that’s on you.

In the end, I decided to bring on a third cofounder to attack the growth challenge with me, rather than forcing my cofounder to reroute energy into sales & marketing using time they don’t have.

First-time parenthood is a big challenge on the mind, body, and schedule, and this has been no different for those involved at Batch, myself included.

To lower the stakes and make things more achievable for us as a unit, I looked to split the workload three ways and reduce the need to show up every day and do everything.

Which is simply impossible while holding a FT job, of course.

And which makes it more likely to build the momentum required to build an attractive fundraising story, which Batch mostly already has.

Instead, my cofounder will occupy a more traditional, part-time CTO role and focus exclusively on technology and product (and personal context) while our newest teammate and myself will develop the foundation required to kickoff top of funnel activities, deliver leads and convert them into new MRR.

Since we haven’t invested a dollar into Batch yet beyond sweat + equity, the cap table is clean as can be.

This is good for late cofounders as it creates more upside for them relative the future of the product.

Since we don’t mind sharing the pie, the conversation has been naturally developing so any gaps between us can be filled by this new teammate, which I hope to introduce soon.

The first order of business is to invest in content for the first time to feed ourselves the leads we need to reposition our messaging, pivot the product and deliver a singular value proposition to a smaller, more defined market than what we might access through the App Store.

Instead of brute forcing our way through the app store (and failing), we’ll leverage organic search as the number one channel to kick off the top of the funnel, with content as the sword and sellwithbatch.com as the shield.

With lead gen hopefully solving within the next 90 days, we can begin aggressively qualifying leads and driving MRR for the first time since launching the app without relying on luck from the app store.

Instead, the goal is to start producing content together that authentically speaks to the customer segments we’re honing to attract, and to make adjustments to product messaging so that the value proposition of Batch might better match.

Basically, we’re giving up on the App Store and turning to more tried-and-true tactics that have worked for us in the past, namely, relying on Google as the search engine to optimize for.

The challenge with Batch is that the job to be done is no longer very clear. We’ll waste thousands in ads trying to test the many different value props that could work.

It’s simply too early and blurry for paid spend.

Over the last year, Batch has created value for such a diverse number of merchants in different contexts that it isn’t clear anymore what the path of least resistance will be.

And we need to attack that first line of risk head-on.

Instead of trying to rank on the App Stores for keywords that fail to fully communicate the problems that Batch can solve, we will make a concerted effort to produce content that communicates the novelty of Batch as a way of solving some of the most typical ecommerce challenges.

Then, we will pivot the entire product towards the message that produces the strongest response (opt-in) rate from leads we manage to attract.

From there, it will make a lot more sense to field some ad spend relative to the newfound message so as to accelerate adoption and effectively start buying MRR from a congruent customer segment.

In many ways, I regret trying to bootstrap Batch. I made life 10x harder for my cofounder who’s trying to juggle FT and Batch.

Bootstrapping something totally novel is unbelievably hard.

It would have been much more manageable to focus on building a strong team from the get-go, but the pressure on that team would have been unbearable as we sailed today’s uncharted territories.

That’s the only reason I couldn’t bring myself to do it.

As much as it sucks, it’s inevitably easier to manage a single cofounder’s challenges and motivation than it is to manage an entire team’s. It’s a different game.

I’ve become pretty unattached to Batch as it relates to the emotions of new startups.

It’s just another project — what irks me is that it has the hallmarks of a winner, but it’s not getting the time and attention it deserves, at least it hasn’t up to now.

In many ways, the challenges implied by the Batch journey are another testament of how much easier it is to buy and grow than it is to build from scratch.

That has made me wonder whether accelerating towards Fund II — and the introducing of a small team to work on the fund’s portfolio — would be a legitimate means of shortening the path to full-time work for my cofounder and other folks I’d love to work with regularly.

If the fund’s primary purpose is to liberate the microangel from FT, and it works at a small scale, then a small team could feasibly enjoy the same advantages and work on a portfolio of products that are default-alive and growing.

But that’s more aspirational right now than it is realistic, and as usual, it’s important to try and focus the variables I actually have control over now, while positioning for luck to turn my way in the future.

As I close the second transaction for MicroAngel, I’ll begin orchestrating lender relationships to leverage the equity I own in the first fund to secure enough leverage to open that door.

Until next time!2

To this day, I’m constantly surprised by how much value is transferred over Twitter DMs. There’s at least 3-4x more activity in private than there is in public, which I think is kind of weird for Twitter, but awesome in so many ways.

I’ve been on Twitter for more than 10 years, but only since launching MicroAngel have I started to tweet more regularly, as a factor of having niched my account down to its core of sharing my journey as a microangel and Shopify app developer.

In that regard, I still feel like a Twitter Padawan, despite observing and identifying the patterns that produce the tailwinds of high growth Twitter accounts.

In the near future, I hope to invest more diligently in my Twitter presence and to start producing threads that share the things I learn day in and day out operating and investing within my small fund.

I’m open to any and all recommendations here :)

Thanks to the following Newsletter Sponsors for their support:

MicroAcquire, Arni Westh, John Speed, Henry Armistread & the many other silent sponsors.

Include your name in every newsletter as a sponsor (name your price)