MicroAngel State of the Fund: March 2021

Bootstrapping Batch, Reconcile.ly + tax season, jittery sellers, and more. Closing MRR: $4.7k / $15k (31% to goal)

It’s been a minute since my last post, but I’ve managed to find some time to crystallize my activities from the month of March.

For all intents and purposes, it feels like the game has finally started as the difficulty has shot up considerably.

As you add responsibilities, the activities you have to do grow quadratically, not linearly. March was far busier than February.

I’m thinking about many more things than I was just last month, and my focus is in jeopardy due to that.

Current fund lifecycle stage

→ Buying (02/2021 - 05/2021)

Fixing (06/2021 - 07/2021)

Improving (08/2021 - 12/2021)

Growing (01/2022 - 08/2022)

Roll up (09/2022)

Exit (10/2022 - 12/2022)

The buying phase of my strategy requires that I be extremely diligent about closing my acquisitions by end of May 2021, yet I could not close a transaction in March, and I’m behind in that regard.

February and March were always going to look really different because of the expectation that I’d be running a product as of start of March (that I’d have acquired in February).

This has been the case, with the acquisition of Reconcilely creating a sudden and considerable need to give the product the attention it requires to ensure a successful hand-off from the seller.

With tax season kicking off, I threw myself into the wolf’s den and began learning the ropes.

While I may want to focus on buying, there’s no escaping the need to fully receive the merchandise you acquire, and to make good on that merchandise so it doesn’t spoil by the time you start paying attention to it.

This has made me wonder just how achievable this really will be with 3-4 products, considering onboarding the fourth product will be incredibly painful assuming I’m already running 3 others.

The activity of onboarding and knowledge transfer itself took far more energy and patience than I had anticipated, and that has brought to light a reality about Reconcile.ly, that it is not as simple of a product as I had previously observed.

The use cases are deep and varied, and the product was built to take them into account. Absorbing all of that information and properly organizing and documenting it has been pretty challenging.

There was so much information to assimilate so quickly:

All the little different ways the product works/behaves

Learning to properly troubleshoot customer issues from the Shopify side, from the app side, and from the Xero side

Deciphering unclear customer requests into human readable subject matter I could understand and begin acting upon

Grasping the technical details implied of a product that I did not create/write myself on the fly

The increase in support burden from tax season painted a varied spectrum of customer use cases for requiring support

While it was painful, in hindsight I’m glad the seller hand-off took place during tax season as that allowed me to be exposed to a variety of different use cases and ways the product might break.

Transacting during the off-season would have returned a faulty reading on the type of questions customers tend to have and the level of activity I should expect in March.

I’m surprised by the different ways a customer will describe their problem, and learning to recognize what a customer’s job to be done really is lies at the core of delivering a 5-star experience.

There is still much for me to learn about the product, that’s the biggest thing I discovered, and accounting is the type of category in which the value of a product is often derived by its ability to be delivered consistently and reliably (support included).

Despite all of this, I’ve only recorded about 15 hours of work on Reconcile.ly over the last month, 12 of which were spent with the seller for technical and/or support training.

I thought I had prepared a strong enough process for the training component, but things ended up being way more ad hoc than I had hoped.

This has led to me reach out to the seller much more often than I’d like to, for small problems that I should be able to deal with.

In the future, I’m going to make it part of my DD process to request a training spec from the seller, and to prepare the topics to be covered far in advance.

Ideally, there exists an SOP for how the product works, but that’s not likely to happen in a microacquisition. And I need to build it.

While I took the time to record most of the training sessions, it would have been much better to obtain some documentation from the seller describing the production and distribution workflows in greater detail.

As I began documenting the code, I came across several sections in dire need of refactoring, giving me some indication about the activities I’ll undertake in the Fixing stage.

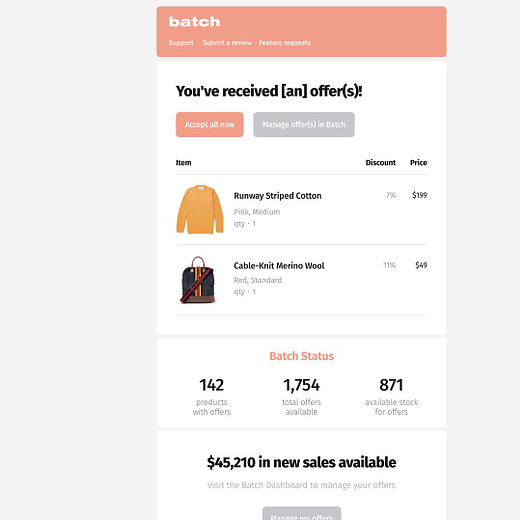

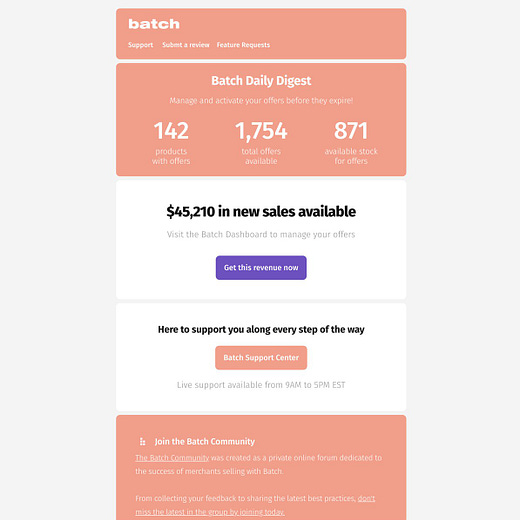

Beyond the increased mental load created by Reconcile.ly, an opportunity presented itself that caused 80% of my focus to swing towards Batch, the bootstrapped project I’m most excited about.

This is why I lost investor focus in March.

Mid-month, Shopify got in touch to let us know that one week later, we’d be featured as a staff pick on the App Store.

For an app like ours which has struggled to find market-fit via the app store’s search demand, getting significant exposure to Shopify merchants represented a huge opportunity in which I had to focus all of my energy.

In the week preceding the feature, my cofounder and I spent some time reviewing our pricing, polishing our onboarding, and solving any bugs that might get in the way of a successful GTM.

The most important change we made was to improve our onboarding by introducing a Demo Mode which basically fills in the app dashboard with mock data for the merchants to play and learn with.

Up until then, revenue for Batch had hovered around $150 MRR. You don’t get far on 2-3 installs per day and $9 pricing plans.

I refactored our pricing strategy to our end-game model, which seeks to collect a success fee from any transaction successfully completed using Batch.

The work involved in the feature alone must have taken 2 full weeks between preparation and the feature week itself.

All in all, Batch fully bloomed this month and I’m very satisfied with my time investment, all things considered.

The payment terms of App Developers are net 30-45, so I don’t yet have an accurate reading of the current MRR.

What I do know is that 80% of what we’ve billed in March (mid five digits) is expansion revenue, which absolutely blows my mind. I don’t know if the math will work itself out as merchants pay their invoices, so I’ll know more in a few weeks.

Between servicing Reconcilely customers and making the most out of Batch being featured, very little time was left over for microangel activities, leading to a sharp decline in lead flow.

You’ll have noticed a slower pace of writing throughout the month. This was an intentional exercise I thought would help me focus — but it hasn’t. Quite the opposite.

What I expected would yield more focus instead caused an inability to clear my mind’s RAM by committing what I know and learn to the newsletter.

I do a lot of my planning as I write, and the exercise makes it possible to declutter my mind so it can afford to focus fully on something else with the horsepower needed to create a breakthrough.

I don’t know if all of it will be interesting, but I’m going to try and commit more from my head to the page so I can build upon what I learn and do.

All in all, I’m pretty happy about March because I got to play the game full-time.

I’m not thrilled at the idea of being behind on my buying, and I’m concerned that will cause me to be more aggressive with offers, but that risk is justified given the Batch breakthrough.

Above all else, April needs to produce some positive momentum on the fund side, and thus the vast majority of my activities this month are focused on that.

Portfolio Activity

Reconcile.ly

A large agency client decided to move on from offering accounting services, cancelling 15 Reconcilely subscriptions in one shot, lost about $300 in MRR to what I’m chalking up as an Act of God.

When I logged on in the morning and noticed the cancellations, I obviously became concerned something has broken overnight and several customers decided to leave.

This stuff happens. I’m not thrilled at the idea of shedding MRR while I’m buying other assets, but that’s part of the risk and the model.

The goal will be to see how much of an impact this ends having on the overall fund. Hopefully, not much, since I’ll start paying attention to my portfolio assets as of June 1st onwards.

The little time I did spend on Reconcilely mostly went into low-hanging fruits, such as app store optimization.

With tax season slowing way down, I observed a decrease in WoW support tickets from 20 to 12 to 10 to 8. This week was 5 tickets.

Weirdly, there was a marked increase of lazy customers who can’t be bothered to actually use the product.

Reconcilely helps send Shopify payouts to Xero. If a transaction in that payout was edited, its details won’t match up the original order and it will be stuck.

The product then makes it easy to solve reconciliation issues whenever they come up.

What I’ve found is that 70%+ of support tickets simply asked for help to deal with such stuck transactions.

The confusing part is that the product’s purpose is to deal with those stalled orders, but customers don’t bother even checking in.

This leads me to believe that offering a $99/mo tier proposing “done for you reconciliation” might work out quite well, both as an expansionary plan as well as an upgrade path for lazy customers.

I’m wondering about pricing it a little higher and building a small network of freelancers off of Upwork to basically offer bookkeeping for merchants through the app, and open up a new revenue line.

Unclear yet if that’s a value prop that would resonate.

I’ll probably do a bit of customer development to make sure this solves the job to done and that the cost of the service is far below the time savings that the clients would benefit from.

Another frustrating element this month was that MRR did not grow despite posting positive merchant growth.

Adding 20 customers over the month, which is exactly the number I have forecasted, should have yielded +$300 MRR.

This is a good example of how customer growth ≠ revenue growth.

The customers I added this month mostly signed up to the $9/mo starter plan, while the majority of the churned customers were on the $24 or $38 plans, leading to overall negative revenue growth.

You can’t really control the kind of merchants who find you on the App Store, especially considering that a decent chunk of installs originate from search demand for specific keywords.

Growing the MRR will likely not happen via the App Store. That really annoys me considering the seller was enjoying excellent unit economics from Shopify App Store Ads.

First, let’s review some of the unit economics for March:

ARPU: $14.54 (-0.14%)

LTV: $206 (-9.81%) → Agency churn

User Churn: 7.58% (+21.4%) → Agency churn

Revenue Churn: 8.18% (-0.62%)

Paying users: 297 (+1.37%)

That agency churn cancelled out all of the revenue growth in March!

Here’s the ad experiment performance for March, on Shopify:

With the release of ad attribution, I can finally get an idea of what my ROAS is. Unfortunately, it’s not good on Shopify.

If I spend $192 CPA, then my payback period will be approximately 12 months (my entire LTV), which is a show-stopper. I want payback to be <2 months considering I don’t want to raise money to grow.

The longer your payback period, the more money you need to have up-front to finance your growth.

The more you grow (the more customers you pay for), the more money you need to field to maintain your rate of growth.

That’s way easier to do if your CAC is paid back within 1-2 months. You can be as aggressive with less cash.

In terms of conversion rate, 17% is much lower than I expected.

In fact, it’s exactly 50% lower than the cost of organic installs, which convert at a rate of 35% from install-to-paid.

In that regard, my CPA is too high to achieve a 2 month payback, and one of the culprits is the install-to-paid conversion rate.

Had it maintained at 35%, my CPA would be halved to ~$97, which would represent a 6 month payback.

At that number, I’d be exchanging $100 for $15 ARPU, which is an OK deal as long as my LTV maintains or grows over time.

I can certainly do better by reducing my CPC, but that will reduce an already low volume of searches.

The app listing converts visitors to installs at a rate of 21%, which is not bad at all, but can be better.

I expect improving the listing’s visuals and adding an explainer video will create some uplift on the conversion and drive down cost of acquisition. Then, I can increase prices and benchmark again.

Since I aim for linear growth, I want to field the same amount of funds into ads every month with the confidence that my payback isn’t longer than 8 weeks.

The only issue here is that my payback is artificially inflated by the payment terms I incur as a Shopify developer. I receive funds on a biweekly payout schedule.

However, I’m only paid out funds that merchants have paid in their Shopify invoice, which includes their app spend.

That means that if I bill you $50 today, I may only see it 30 days later (in 2 payouts), or even 45 days later (in 3 payouts) should the customer fail to pay their Shopify invoice on-time.

It’s unclear how much of an issue this is going to be. I may have customers who have paid that Shopify isn’t reporting properly, or they may appear in subsequent payouts.

Not having a clear picture of the present makes it hard to measure.

You cannot improve what you cannot measure. If my measurements are lagging, so too will my readjustments.

That said, April is turning out to be much, much calmer.

There are a few interesting use cases coming in suggesting Shopify is beginning to adjust some of the verbiage they use to describe transactions.

Since I spent a bit more time in the product while giving support, I noticed where it falls short.

The UI is dreadful, but there is some potential to leap over the rest of the competition with a radically new value proposition.

I’m continuing to keep track of my backlog for Reconcilely so I can begin attacking it once I move on to the Fixing phase of the strategy.

Batch

March was a truly special month for Batch!

I spent most of my time on feature preparations.

In Q4 of 2020, we made the decision to stop focusing on the App Store to build a few assets & own demand generation of our own as we had failed to secure strong app rankings on the app store.

We built the first version of sellwithbatch.com, including an innovative flow that enables new customers to install the app without ever leaving our website.

This new infrastructure was put together to support ad ops and content marketing. We kicked off the blog but don’t have a ton of time to dedicate to it. I’m about to bring on a content marketer.

We wanted to run ads but didn’t feel comfortable throwing them into the app store. We’d prefer to control the onboarding UX.

The reason we built a blog too is because it is evident we need to educate our market about this new category we’re building.

As it turns out, 80% of the growth of a startup tends to come from a single channel at any one moment.

The kind of channels that lend themselves to this role are compatible with the lifecycle stage of the startup in time.

A totally new startup cannot afford billboards. Channels open and close as the product and customer acquisition cost changes.

The most important thing at the pre market/product-fit stage is to identify that 80% channel. There aren’t that many out there, and most are going to be long shots anyway.

For Batch, I identified only a few key channels we must get right:

To my incredible delight, Batch hit and outperformed all of its benchmarks by several orders of magnitude.

When I built my model, which you can follow on Udemy, core assumptions about the product were made to derive ARPU:

Would focus on $1M+ stores

Would produce a 5% revenue-add (i.e. $50k+)

Would bill 4% of revenue-add

ARPU of $167, ACV of ~$2k on a $1M store

Double the ARPU/ACV on a $2M store, and so on

I expected merchants to activate once a week to deliver that 5% value-add. Instead, I’m finding merchants activating as much as 75 times per day, leading to an explosion in revenue expansion, and a far greater value-add than previously anticipated.

Customers who sign up to the $100/mo plan are subsequently billed between $500 and $5,000 per month in application fees from driving tens and hundreds of thousands in new revenues for their store.

A bunch of VCs reached out with interest and I’m taking meetings.

The response is next-level, and I’m spending all of my time basically building or recruiting to execute against those 5 main channels.

Some of the success stories coming out of Batch so far:

One beta merchant ($3k/mo) joined 6 months ago and has added $1.5k/mo in sales every month since, like clockwork, increasing her total revenue by 50%

One customer who joined a few weeks ago was on the brink of bankruptcy. Batch now represents 100% of their sales and they are soaring

An art gallery sold out of stock in less than 10 minutes by letting customers make offers ahead of time (item drop)

A jewelry store accepted 75 offers in one day for over $30,000 in sales ($1,200 of which went to us)

A Shopify Plus merchant was featured by LaGuardia, Spain's most popular fashion magazine, for their innovation selling with Batch

A digital marketer sells more than $20k/day in Certification Courses by letting students apply for scholarships that let them choose the amount they can afford to pay

At this point, most of my attention is swinging over towards hiring the best possible talent I can find.

Number one on my list is a AAA VP of Sales or CRO who can build out the sales org and start aggressively driving ARR in the mid-market.

PartnerCRM

Amazon has an awesome strategy which converts cost centers into revenue centers. I seek a similar outcome for the things that cost Batch time or money, when and where possible.

Driving MRR as a Shopify app depends on very strong customer success, but the tools at the disposal of developers are extremely limited.

This drives most developers to slap together home brew back offices that give them some control over the outcome of customer journeys.

We believe that it would be much better to decentralize that functionality and productize it so other developers can benefit from it. Right now, we’re building it ourselves, but I’m starting to think about open sourcing it for the greater good.

I’m confident open sourcing would accelerate the product’s improvement (via community PRs) while also increasing lead generation for the hosted version, which we can continue to offer in exchange for MRR.

Fund Activity

Funds Deployed: $148.5k (29.7% of funds)

Products: Reconcile.ly

Current MRR: $4.7k (31% to goal)

MRR Growth: -4%

Total Revenue: $4,915

Headlines

Conducted 9 Zoom calls with sellers

Spoke to 9 unique sellers

Submitted 4 LOIs, 2 accepted

Disqualified 2 deals in due diligence

Lost 2 deals at the LOI level

1 deal lost to a large, public buyer

1 deal lost to buyer choosing to hold business

Current Deal Flow

Open Conversations: 8

LOIs submitted: 2

LOIs accepted: 1

In diligence: 1

Most of my angel work was focused on a single deal I worked hard to make happen. I had to focus on Batch and simply ignored several inbound deals, and performed zero outreach in the month.

Unfortunately, it doesn’t look like the transaction I’m interested in will materialize and I’ve since moved on to other opportunities.

Something I’ve been thinking a lot about is reducing my expected cashflow target so I can re-route some resources into Batch and/or to invest into the products themselves.

While I could probably hit my MRR targets with $50k to spare, it would be interesting to consider what that investment across the portfolio would look like.

In April, most of my focus is on deal making as I’m now behind.

Last week, I lost two interesting deals to seller uncertainty where the seller could not consolidate whether they really want to sell.

I’m a little surprised to see deals of that size appearing just to test the market, and I’m going to adjust my approach to pre-qualify sellers more, even if they are openly interested in selling.

Interviewing sellers takes a lot of time, but skipping that step has produced worse results. Quality over quantity.

Learnings & Adjustments

Batch is ready to launch to the moon way earlier than expected. I literally created this fund to prove I could sustain myself while working on Batch up to this point.

With Batch taking off, I’m forced to decide whether my funds would be better invested in a proven asset I already fully own.

At this point, every dollar I invest into Batch is likely going to output a much higher valuation increase considering it is a cash machine in need of seed capital.

I want to start hiring the best talent I can get and aggressively work towards a $1M ARR run-rate. With the incredible ARPU it can produce, that could be possible with as few as 50 customers.

My gut says it’s time to swing all my weight into it — I’m considering the impact that will have on the personal fund. I could potentially move straight to a rolling fund and re-assess the mission. Or simply raise a seed round for Batch.

I’m going to continue searching for a great deal, but if I end April without a transaction, it might make sense to seed invest directly into Batch and take home the equivalent MRR I’d require from other MicroAngel acquisitions.

Top Posts This Month1

My micro-acquisition process from first-touch to close & asset transfer — Part 1

Structuring micro-acquisition deals creatively for maximum cash flow & IRR

Bouncing back from losing a big deal to an even bigger competitor

Thanks to the following Newsletter Sponsors for their support:

MicroAcquire, Arni Westh, John Speed & the many other silent sponsors

Would love to see the damage you could do going all in on batch. Seeing such early traction is wild. But would also really like hearing the acquisition process. Not sure you can go wrong in any direction here. Going to be an awesome ride and I'm thrilled to have a front row seat. Great stuff as always!

where can we get K-1 for our investment?