MicroAngel State of the Fund: November 2021

Cash-on-cash wins, shipping product improvements, removing zombie accounts and a brand refresh. Closing MRR: $24.7k

The month of November was replete with deep experiences, learnings, rewards and surprises. It was also the most fun I’ve had in quite some time!

Where the start of this journey required extreme discipline, grit and determination, the Improvement phase is proving to be the one I feel most comfortable with so far.

I’m in the zone!

It has so far provided the opportunity to touch and feel the product as it improves, while having a direct line of communication with the customer who uses it.

There is a hustle and flow in the way we work as we’ve graduated from bugs towards new and uncharted territories, and we’ve got much to show for it.

Every month, I zoom out of the challenge to understand if we’re going in the right direction.

Since I spend most days extremely focused on the product right now, I don’t necessarily check into the revenue metrics of the products on the daily, unless something weird pops up.

But it’s been a good, dare I say, great month despite some interesting events and discoveries, though we personally felt like we didn’t quite get rewarded for our efforts.

Read on!

Current fund lifecycle stage

✅ Buying (02/2021 - 05/2021)

✅ Fixing (06/2021 - 08/2021)

→ Improving (09/2021 - 12/2021)

Growing (01/2022 - 08/2022)

Roll up (09/2022)

Exit (10/2022 - 12/2022)

Fund Activity

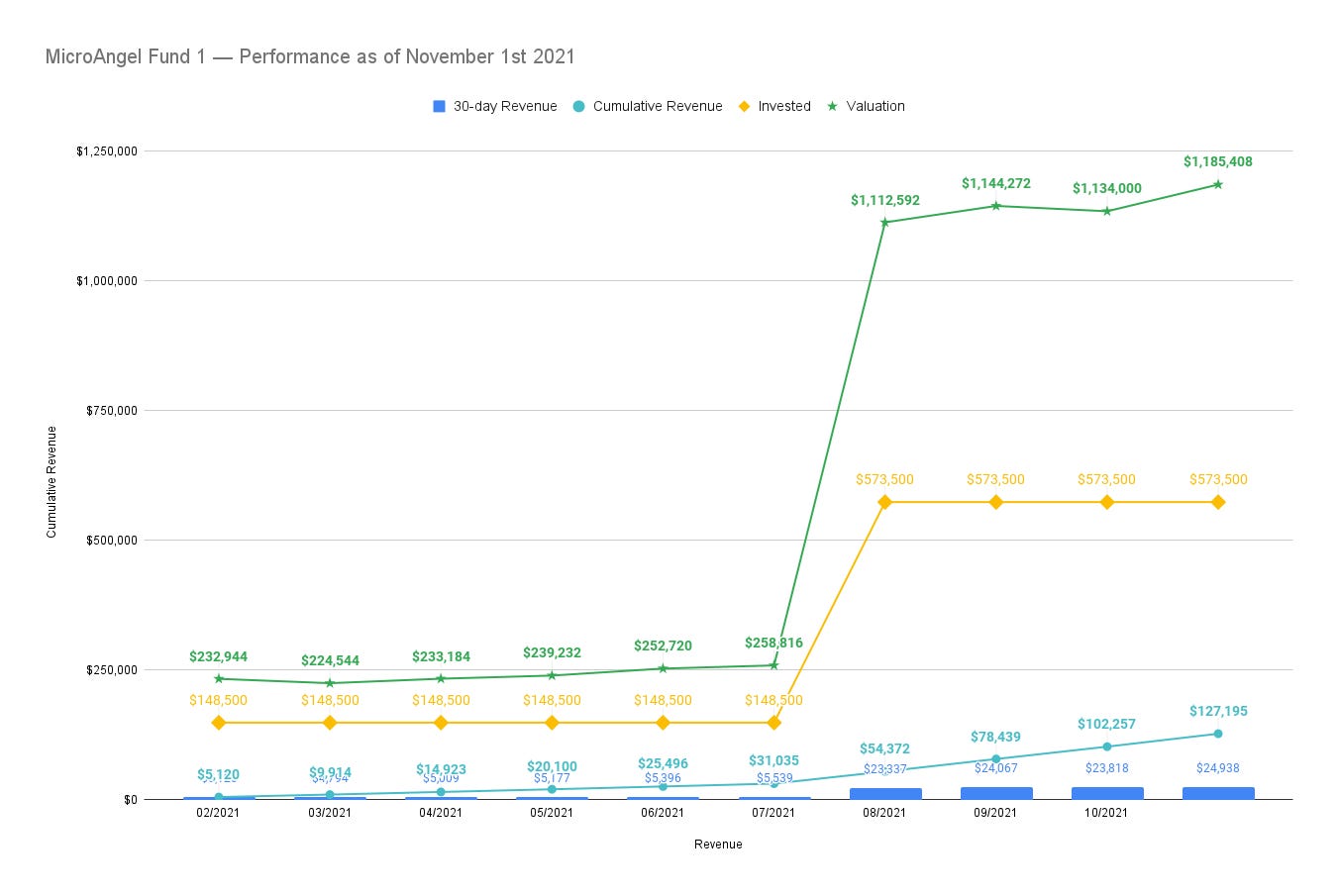

Funds Deployed: $573.5k

Products: Reconcile.ly, Postcode Shipping

Closing MRR: $24.7k

MRR Growth: +4.53%

30-day Revenue: $24.94k

Rolling cash-on-cash return: $127.2k (+22% / +0.22x)

30-day ARR growth: +$12.85k (+4.53%)

Cumulative valuation increase: +$611.91k (+107%)

Current Total ARR: $296,353

Fund valuation @ 4x: $1,185,408 (+107% / +2.07x)

10-Month Total Return (MOIC): +129% / 2.29x1

In the beginning of the month, as we wrapped up a bunch of cleaning for Reconcilely, we discovered a part of the code that made us wonder if certain customers who were marked as paying were in fact paying.

To our dismay, we discovered more than a dozen zombie accounts that were uninstalled, but had not been marked as such.

The result is that the revenue we reported on our internal dashboard went down by a few hundred bucks, which initially made us feel pretty crappy.

But we later realized that we hadn’t been actually billing these customers (as they were uninstalled, and we thus could not) over the past several months anyway. They were very old zombies 🧟♂️

Which means this crappy discovery ended up being a dud — it didn’t affect our actual revenues at all. 😅

What it did do is increase the accuracy between our internal dashboard (which counts customers marked as active in the database * the amount in their plan) and what we observed in the Shopify payouts and dashboard, even though the latter is a lagging indicator.

As I zoomed out for the first time of the month today, I discovered that things have been continuing to go in the right direction. I’m late on sending this report, and that’s completely due to prioritizing product as I wrapped up some sexy new stuff.

In major part, I have my support team to thank for our strong month as we’ve again spent most of our energy on Reconcilely as opposed to dividing and conquering. They’ve been our rock.

With Eric transitioning mostly back towards Postcode Shipping over the month of December, I expect he’ll probably do a review of the UX and get a strong understanding of any open issues or bugs that might be affecting it.

I’ll continue to work on the new Reconcilely features and kick off the GTM for it as we release the brand refresh, new marketing site and blog launch.

There’s not a whole lot to improve on the product side for Postcode Shipping, which is why we’ve been allocating most of the phase to Reconcilely so both products in the portfolio can be in a good place to spend 80% of our energy on growth.

In the meantime, we delivered the goods this month, releasing more new features in the last 30 days than we have in the past year combined.

This resulted in solid product-led growth for Reconcilely as it scored a new record for new 5-star reviews in 30 days.

It’s full steam ahead as we continue improving the products.

I’ve a half-mind to continue doing that for the next month or two because every new feature we’ll be releasing moving forward has a strong affinity to MRR growth.

You could say it’s good tactics to focus on product to increase ARPU and conversion prior to focusing all of your energy on marketing and growth systems, but I recognize the truth that I could very much be doing that now.

As you’ll see below, real progress is only possible if you focus most of your energy getting one thing to the finish line at a time.

If you’re bootstrapped, staying in your lane is one the most fundamental things you can do to multiply your results.

Reconcilely

Our main OKR for the past little while has been positive reviews on the Shopify App Store.

It’s the purest demonstration of progress vis-a-vis the organic channel most responsible for our new install growth.

While we observed a sharp decline in installs in what could only be described as a seasonal dip, our own work within our active customer base continued to accelerate as we released requested features and earned more great reviews that further increased our current velocity.

While I plan on spending a bunch of energy on refreshing our app store listing as well as doing some optimization of our rankings, the impact provided by more reviews can only be positive.

Cool fact: For the first time, positive reviews came in about new functionality rather than great support.

The great support is a true constant, which means combining it with completed feature requests has a near 100% conversion rate as it relates to new 5-star reviews.

Which makes sense, that’s the entire point of an app, and it is the type of workflow that rewards all parties involved between Reconcilely, merchants and of course, Shopify.

The first batch of improvements aimed at delivering new reviews, and they did.

However, they didn’t have much impact on MRR, which on a macro scale, could probably be considered a bad decision.

Fortunately, I understand the direct relationship between organic ranking and reviews (as well as new review velocity) and I recognize the opportunity implied by going up rankings which is no small feat to achieve beyond listing optimizations.

The other OKRs we obviously care about is new installs and new MRR, which are tightly interconnected.

Because we have a great conversion rate to paying customer from install, we can get new MRR by simply getting more app installs.

Another way to increase MRR is by improving the revenue per customer, which can be achieved by helping customers spend more with you i.e. by upgrading their plan.

You can get them to upgrade a plan by locking new features behind higher-end plans.

That’s the circumstance in which new features can contribute to new MRR and you know you’re doing it right if upgrades start to come in shortly after your email announcing the feature.

Before working on new features, we delivered functionality to satisfy 6 feature requests and quickly cashed in on the good faith that produced with customers.

In fact, we delivered more new code this month than we ever have in the past, as our engineering velocity skyrocketed:

Importantly, I also pushed v1 of the Segment CDP implementation.

Having a customer data platform is crucial as it relates to piping information from your application to the rest of your stack.

I originally planned on implementing only Rudderstack, but ended up sending the information to both Segment and Rudderstack. My plan is to make the most out of the free plans there by intelligently allocating which CDP which data goes to.

It’s a bit of penny-pinching that ends up having a big impact on the bottom-line. A penny saved is indeed earned in this case.

For me, the first order of business was to establish a baseline of events and properties that I could start passing to analytics products and get an idea of customer behaviour at a micro and macro scale.

Thanks to this implementation, I can now pass key events to ad platforms for ROAS calculations. For starters, I can now accurately tell if a click ends up in an install, rather than having to estimate.

And of course, I can pipe that data across to most tools I use.

Next, we’re kicking off pricing adjustments soon too.

I’m looking forward to releasing a credit-based approach for overages rather than nickel-and-diming customers.

This will result in greater convenience while doubling the revenue potential of the overages.

We’re also going to be introducing a free plan that will provide a generous lifetime number of orders rather than on a per month setting.

That should help us stand out from the rest of the competition.

Also, it will give customers the time to build trust in Reconcilely over time before upgrading to continue receiving service OR get better features.

Things are looking up on this side. I’m excited to keep working on the product now that it is so much more stable.

Postcode Shipping

While the work for Postcode Shipping is mostly on the marketing side, and that work is pending a product catch-up from Reconcilely so we can benefit from killing two birds with one stone, I did kick off a few conversations to help orient our roadmap.

Since it’s growing well, and has a healthy conversion rate from install, exposure is what we want, and that can be achieved through technology partnerships that make the app functionality available in other products our target market might be using.

One such example is a reporting product that asks the customer to manually enter their shipping rates to enable other functionality.

Postcode Shipping could easily provide this (complex) information without involving any manual intervention from the merchant.

I’m discovering that Postcode Shipping has a fairly interesting API opportunity by making the data it has or crunches available to those apps, which would then earn us a link-back to the app, and a likely install from customers happy with the integration.

In the meantime, we’re entering our last month in the agreed upon hand-off period and we seem poised to continue maintaining and growing the product as we move forward.

I’ve been pleasantly surprised by the grace with which the product handled Black Friday and Cyber Monday (BFCM) weekend. Support requests didn’t necessarily pop, and nothing in our customer checkout process broke. Which is a big win.

Every few days, I read through the support tickets handled by our team to better understand if and where the customer gets stuck. The roadmap is slowly coming together in that regard, but like Reconcilely, deep progress is only possible if we make it the only thing we focus on.

I’m now a regular in the Australian and NZ social media groups focused on Ecommerce with Shopify. The direct line of sight helps me understand what the customer cares about while maintaining a legitimate means of recommending our apps if and when appropriate.

All things green here, but we look forward to stabilizing the allocation of our attention between our portfolio so we can start releasing features for Postcode with a strong affinity for pricing upgrades.

The MicroAngel Awards

The MicroAngel Awards pot is now up to $3,150. When it hits $5k, a lucky MicroAngel subscriber will win a MicroSaaS business!

Please get in touch over Twitter if you wanna sponsor. Otherwise, be sure to subscribe to both contribute and gain a chance to win.

Learnings and adjustments

Keep on trucking is the #1 relearning.

We’re doing it right, we’re not skipping any steps, we’re doing the hard thing first, and the seeds are starting to show promise.

Next month we’re going to reach 25% in cash-on-cash returns, which is a huge milestone to reach before the first year end. Products are in a good place, nothing is on fire, but we could be growing faster.

That’s on-pace with our goals for the year, which were to acquire, fix and improve a portfolio of products that could then really take off the following year.

I strongly believe the work we are doing today to improve Reconcilely will liberate our creative energies so we can reroute them towards the mission of rapidly increasing MRR before starting to think about rolling up.

Considering the incredible impact Eric has had on our velocity, I’ve been mulling bringing on a third partner at MicroAngel to effect a similar change on the growth and marketing side.

Despite it being my go-to role, I’m likely going to reap more returns from continuing to do what has worked well for us this year, which can be summed up as creatively and intelligently acquiring fantastic products from the onset.

From there, everything has been going along in the right general direction, and provided you can roll with the punches and stay flexible, you’ll find you have the ability to wrap yourself around just about any problem, solve it, and then double-down on your solution as a means of increasing total output.

Stay like water, my friends.2

0.22x delivered via cash-on-cash so far. I’m aiming for a total of 0.7x (70%) over 2 years, ending in February 2023.

Currently doing approximately 4% per month in cash-on-cash and there are 15 months left in the journey.

That means I should produce 0.22x + (15 * 0.04x) = 0.82x by maturity.

We’re on pace! Onwards!

Thanks to MicroAcquire, Arni Westh, John Speed, Henry Armistread & the many other silent sponsors. Sponsor MicroAngel