Productizing MicroAngel Returns: Part Two

Exploring game theory components to give life to a two-sided marketplace & designing a Decentralized Autonomous Organization

If you’ve been following the MicroAngel experiment since the start, you have an implicit understanding of the tangible benefits made available by this model.

But you’ve also bared witness to the challenges that can forced upon unwitting investor-operators.

Despite those challenges, the value far outweighs the risk, and the inconvenience represented by the challenges of a microangel pale in comparison to the tumultuous journey of a bootstrapper.

We describe here the value and effort gap between the options of starting from scratch and buying instead of building.

The gap is greater still when introduced to the idea of simply buying MRR rather than buying products outright and operating them.

The gap sure exists but it would still be a lot of work to find the right products to buy MRR from, not to mention other mechanisms used for sending offers, receiving payments, and so on.

It’s a lot to manage manually so forget doing it at scale.

That’s why I started exploring how to productize MicroAngel in a way that wouldn’t require an investor to generate acquisition leads or operate products.

To introduce a new asset class that would open the MicroAngel model to the masses, eventually benefiting both bootstrappers and investors as they would participate in a new reality made possible by this new paradigm.

I truly appreciate all of the initial feedback and reactions you’ve submitted. They’re in line with much of my own thinking, but some things did float up much more often than others, and that is the basis upon the continuation of my exploration today.

The Elephant in the Room

First, it’s important to address what happens if the product fails which I think is the elephant in the room given the feedback I got.

Number one: if it dies, it dies.

There's nothing that can realistically be done about that end result, but it's important to explain the context of the marketplace upon which such a result could be possible:

it's a marketplace, so you discover products to invest in in listings and/or in the wild - think of a indie hacker twitter bio leading to a landing page showing open metrics about their MRR and product + CTA to buy MRR

it's up to the investor to do their due diligence but the platform tries its best to surface things that help make up a decision

it's up to the investor to make an offer on the MRR (i.e. i could offer 2x for $1k MRR -> $25k one-shot - they might accept), so they manage their risk relative to their offer

It's like a cap rate on real estate -- the higher the multiple, the more (presumably) stable the MRR you are buying and the less likely it is to go to zero

you're buying net revenue not expenses so the risk vs return is quite good

you will presumably only buy MRR from products you strongly believe in but my vision is to be able to buy MRR from products I use.

Notion makes a lot of money. I wouldn't blink twice paying $50k for $1k MRR from them but the multiple might be higher.

Beyond some of those elements, I have learnings of my own from the past year:

The number one basis from my thesis is to buy instead of start.

That means I buy something with PMF from day one.

It gets progressively more unlikely to die with PMF and a product that answers a strong pain supported by the right business model.

I only bought products that fit a certain description and scored each potential lead on a 24-point scale which I then turned into a % score.

I only made offers to products with a score of 80% which, considering the things they would have at their disposal by virtue of that score, brings the likelihood of death to near zero

I could take off for a month and not do anything whatsoever and my products would not only continue to function without my presence but their MRR would actually continue to grow.

There is very little i can do to kill the products to zero beyond Shopify kicking us out of the API on a random day. There are no other events that could ever lead to a direct death

Let's say Shopify releases native functionality that does what one of my apps does. My churn might go up by 10% and I might even slowly start to bleed as I try to figure out what to do.

In that time, MRR holders might start to liquidate their positions, while other riskier investors might buy into the MRR at a discount

These are also platform events I have to prepare for:

if product dies

if product fails to make a payment

if product is acquired

I think the game theory should always be set up so that the damage made to bad actors is always many times more to anyone they'd damage as a result of bad action.

So it naturally stops them from doing bad shit, but some natural churn (i.e. products failing) could definitely happen -- and as crazy as it sounds, I think that any investors would share the blame provided they'd invested in something without the legs to continue

Beyond the game theory, I think it's important to think about how to reduce micro risks for sure.

If a startup fails to make a payment, perhaps the platform guarantees the payment to investors but then claws back the product from the original founder as they'd fail a payment (as an example).

Then liquidate on MicroAcquire.

What if a product gets acquired?

So what?

What is actually being acquired?

If I have $10k MRR and I sold $9k MRR through this marketplace, I only really have a business doing $1k MRR so that's all I have to sell.

Buuuut I still have secondary sales rights over the $9k MRR I sold so were I to get acquired, I assume these rights would also get transferred.

So the buyer gets a $1k MRR business + the right to resale % off the $9k MRR in circulation.

A $12k ARR biz could probably sell for $50k right now (4x) but if you take into account the resale rights, the value in total might be higher.

But that's not all!

When a creator sells MRR in this model, they should have a right (as the original seller) to buy back the MRR at any point for a predefined multiple.

So if you buy $1k MRR from me for $50k (4.17x annualized revenue), I would have a perpetual right to buy back that MRR for, say, $60k (a 20% predetermined premium).

So any acquirer could realistically buyback all the MRR and cause another liquidity wave which would pay all existing investors + the original seller on the secondaries.

How does the value of each MRR chunk react relative to new revenue milestones by the product?

Does it even need to?

Would be cool but would carry some consequences.

I really like this MicroRoyalties concept. It has strong legs

But it contains so many dimensions. And that’s going to beget a long 0 to 1 period.

I ought to cut up that long journey into smaller chunks, and execute a simpler approach that will still act as source of insight to help validate/invalidate any of the core assumptions related to the MicroRoyalties concept.

An idea is just a seed — it’s important to let it evolve and change over time to align with implementation and market dynamics.

Where Web3 shines

To make the right decision, every opportunity needs to be given equal weight, as though it were your only option.

That forces you to make the most out of the option and to extract the maximum out of it.

The question of whether to use Web3 was directly tied to the eventual prototype I’d want to field.

If a core hypothesis I was making relied on behavioural or economical machinations present in Web3 communities, then the merit for building using Web3 technology goes up.

This reminds of Brian Balfour’s approach to growth.

A successful product manages to symbiotically merge 4 core concepts, one of which you are likely intimately aware of:

Market/Product Fit — the match between the product’s value proposition and a market whose pain is solved by the product

Model/Market Fit - the match between the market and the business model used to convert value into money

Model/Channel Fit - the match between the LTV enabled by the business model and the CAC required by acquisition channels where the market lives and can be accessed repeatably

Channel/Market Fit - the match between the eligible acquisition channels and where the market actually lives

In this case, I’m most concerned about channel/market fit. My market is comprised of early adopters who are looking to invest in financial tech that challenges the status quo they suffer from.

There are many of you on the newsletter who consume the content within it while cultivating aspirational goals as future microangels.

You may have convinced yourself that this model is only possible if you’ve got $500k+ to invest (it’s not btw), and part of why I want to figure out how to buy MRR in little chunks is to reduce the financial threshold from which one could participate.1

That’s OK, we all have demons to conquer and mountains to climb to materialize our dreams.

One of my dreams is to democratize the life MicroAngel has made possible to other likeminded individuals.

A sorts of medivac helicopter that can take you straight across the greatest mountains and to let you start playing the game with however many chips you wish, while having the depth to grow with demand into something greater than yourself.

Last time, I identified the main goals I had going into the challenge of figuring out how to properly productize MicroAngel.

Specifically, I want to maintain the same returns, but scale my investing.

I can’t scale my investing on my own without bringing on more people. When you do that, the thing you are inevitably changes.

I don’t necessarily want to manage a team or even operate products.

I want to buy MRR at a multiple that makes sense, but be able to liquidate my position anytime I want to some other investors.

Importantly, I want others to benefit from the same returns, but I recognize they could never provided what it took to get Fund 1 launched and executed to maturity.

Living in the future

There’s something special about trying to live in the future.

The missing pieces just come together because when things work well, they tend to be quite simple in retrospect.

And you can observe into the future through that lens.

Trying to imagine daily life interacting with something that doesn’t yet exist creates a set of boundaries for how or why or in what way that thing might exist and eventually behave.

For me, the first place my mind went was the MRR chunks.

I want to buy pieces of MRR.

And everything went from there.

The good thing is that the concept I ended up with is a generational leap forward as it relates to indie hacker financial independence, but it’s not something I can realistically materialize on my own.

Speaking with many of you and others in my network, I learned about some of the financial magic, legal boundaries and product nuances that will make this product both difficult and worth building.

Over the last week, I tried to walk back along the path of bread crumbs I had left for myself across this newsletter and personal notes.

And I came across the Web3 question again, except this time I gave it a chance rather than immediately striking it.

Were I to try building an MRR acquisition marketplace, web3 would not be the correct choice.

But if that’s not what I’m building — if that’s not the market I’m serving — then the question is worth revisiting.

And you know what, in giving it that second chance, I realized there is a less treacherous path to a first iteration of this project, the existence of which would lay the foundation for a logical evolution towards the MRR acquisition marketplace thereafter.

Unfortunately for some, the use of blockchain technology might either push or price them out.

I understand and recognize that risk, and I will do my best to mitigate it.

But the fact is that I can achieve all of the high level goals I want out of the second fund above without having to build the entire castle all at once.

Here’s the second possibility, and it’s not that farfetched.

MicroAngel DAO

Since the start of the concept, I've been mostly thinking about a solution that feels a bit like P2P pipe + mainstreet + stripe + baremetrics.

I see a marketplace allowing startups to raise non-dilutive, non-debt financing that allows investors to buy pieces of MRR for a set revenue multiple with many fintech mechanisms inbetween to power a secondary market, itself core to the design.

The challenge of course was trying as much as possible not to use any web3 technologies and to stick to existing infrastructure.

Stripe APIs.

Google Analytics.

ChartMogul.

But the challenge I have has to do with project scope, not technology.

There are a lot of design systems that would eventually have to interact together for the platform value proposition to come together.

Consider the following value dimensions:

1. Monthly MRR distribution vs. Operating a product

2. Indirectly support team vs. Actively managing staff

3. Acquiring chunks of MRR vs. Acquiring products outright

4. Introducing rolling raises for products without equity/debt vs. selling equity/adding debt

5. MRR buyback rights vs. Paying back loans

6. Secondary sales rights vs. Royalty contracts

7. Voting rights vs. Loss of Control

8. Access rights vs. Invest & hope

It's a lot of different things that come together, and I recognize it's too much.

The challenge is that a new asset class has to cover its bases across all of those dimensions, as can be seen in the early exploration above.

That includes protecting products / investors and the platform itself, and I don't want to waste months upon months trying to elucidate all of that when I could make a pretty good move that is concentrically related to the MRR acquisition marketplace.

So, what does that look like?

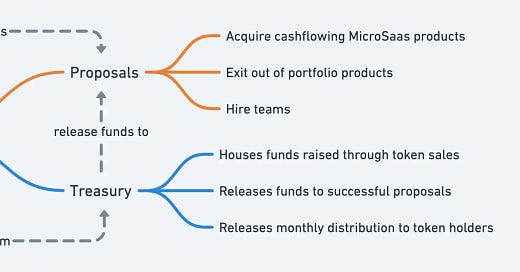

I'm exploring a MicroAngel decentralized autonhmous organization (DAO) built upon the same platform model as Compound Finance and the investment model or MicroAne.

It which would contain the following features:

Decentralized governance allowing a group of investors (us) to co-invest in micro-acquisition projects together

The purpose of the investments is identical to MicroAngel fund 1 → buy up MRR and perceive cash-on-cash for a period of time, and then some returned multiple on invested capital through a micro-exit several months later, at some target multiple

DAO members share the monthly profits generated by the MicroSaaS portfolio held by the DAO

A central treasury from which funds would be disbursed for acquisitions and any other proposal that passes in the DAO

Increasing the value of the treasury through the sale of an access token with which to access and participate in the DAO

The token sale is manifested by MicroAngel minting a single NFT per day (not a massive collection), every day, forever, and putting it up for auction to the public

95% of minting sales go to the treasury, 5% to team

Holding an NFT provides a single vote in the DAO + pro rated MRR distribution

Create an interface for any DAO member to observe portfolio, manage rewards and participate in proposals for new micro-acquisition + enable other members to vote, with quorum and time locks in the smart contract

A secondary market will exist for DAO access tokens (NFTs) on OpenSea, allowing anyone to liquidate their position at any time, a feature that will test a core behaviour of the eventual MRR acquisition marketplace

Enable existing investors to buy in (pretty much) as LPs but also allowing anyone else to participate.

The vision is to eventually reduce the barrier of entry to the equivalent of 0.1 ETH (for example) via the future marketplace idea, but this model allows for good treasury value without having to involve several thousand investors

It's merging an LP fund into a DAO, and then utilizing the DAO itself to eventually fund proposals like the MRR acquisition marketplace concept, with the learnings established through this one.

What’s nice is that because it solves all of the high-level goals of the second fund, including continuing to perceive cash-on-cash returns every month, not operating products, being liquid, and so on, the bulk of the value this DAO can unlock is in the future.

In other words, what’s really valuable isn’t what it can immediately solve but rather what it can make possible in the future.

As several hundred investors command a treasury that continuously grows, new projects can be born out of proposals which could be executed upon as a community.

It doesn’t have to just be about acquisitions.

Someone could propose a MicroAngel product studio funded by the treasury.

And that proposal would probably pass, get funded and built with the support of hundreds of microangels and other funds.

A working example

The above value proposition is uniquely suited to the concept of a decentralized autonomous organization.

Remember when I said I had no interest in running a fund?

I wouldn’t have to.

I could participate in a fund, but all DAO members would fundamentally be participants without any one individual having to make decisions.

That’s the entire point.

Another critical reason why Web3 is actually the right channel.

I can only eat the cake and have it too through a trustless system that neither relies on me operating products nor decision making at the fund and portfolio level.

While the treasury might reward me for building the DAO (my new job), I would fundamentally be one of us, investing and voting alongside you.

That could raise questions about governance, and there be dragons there too, but far fewer I think.

It’s a more straightforward direction that has existing working examples, my favourite by far being the Nouns project.

Nouns.wtf

It’s a simple project executed to perfection, with micro- and macro-economic game theory that results in a closed-loop ecosystem which both survives and thrives without having to involve thousands of smaller investors, all while back-pocketing the long-term depth to scale to that size.

The core idea of the Noun project is pretty simple.

Pictured above is today’s auction for Noun 309 — implying that 308 Nouns have been minted until today over the past 308 days.

One noun is minted and auctioned per day, forever.

Every tenth noun goes to the team.

The current high bid for Noun 309 os 60 ETH, or approximately $125k.

Mind you, that’s the acquisition budget of many, many MicroAngels — both all-cash and debt-powered.

The auction for Noun 309 will end in 22 hours, 44 minutes and 6 seconds.

Provided there are no more bids by the end of the auction, Noun 309 will be transferred automatically to the current high bidder, poap.eth, who will automatically send 60 ETH to the treasury.

At the time of writing, the Nouns treasury holds 23,992 ETH, or approximately $48,135,415.

That’s a lot of money, you might think.

What in the world are these investors doing with that?

Why the hell would they buy JPEGs for $100k+?

I won’t convince you to buy an image of an ape.

This is not an entertainment concept. It is a utility concept.

Consider Noun 287:

Each NFT is an irrevocable member of the DAO and inherits a single vote that can be used to help pass, stop or abstain from proposals.

In this case, the owner of Noun 287 voted:

FOR a live proposal intended to launch an apparel partnership between Nouns and Madhappy

AGAINST a sponsorship proposal for a Rally championship

FOR a passed and queued proposal to shoot a documentary

and so on.

Anyone holding that NFT can participate and vote:

Anyone holding an access token can submit a proposal and make a case:

And it doesn’t need to be any more complicated than that.

Proposals could be used to:

acquire new projects

sell existing projects

adjust profit ratios from existing projects

reinvest a % of profits into marketing projects

funding and spearheading cross-selling partnerships

hiring for the projects

hiring for the DAO

funding community initiatives and tools

and so on.

And the secondary market would exist by virtue of the ERC-721 tokens themselves.

The value of the DAO would grow with the number of its participants.

In this scope, I could realistically create a working prototype with a similar model, ensure it aligns with the goals of different potential investors across the MicroAngel newsletter and beyond, and get started from there.

I could fund the development and maintenance of the DAO through the treasury and creator royalties.

Will it be easier to build? Probably.

Is this going to alienate investors who don’t want to jump into Web3? Probably.

An OTC trading desk partnership can solve this. It has in the past. Reputable on- and off-ramps in-and-out of crypto have been solved for awhile now.

Is this an ideal use case for a Web3 platform, the likes of which could shift the perspectives of those investors? Probably.

Would the value of these NFTs be directly derived from the value they return every month and resilient to crypto volatility?

Definitely.

And that’s exciting.

It’s not vaporware.

I haven’t yet found any holes with this approach and as always, I’m open to your feedback.

What excites me about this is the prospect of bringing all of you along for the ride, for real this time.

Will of course share more as it comes together. But you’re now part of the story.

If you made it here, you’ve swallowed the red pill. Wake up!

Looking forward to hearing from you.

Til next time.

Thanks to MicroAcquire, Arni Westh, John Speed, Ariel Jalali & the many other silent sponsors.

→ Sponsor MicroAngel here ←

while also figuring out a way to remove the operational requirement altogether, a component that is critical to mass adoption of the idea of buying MRR in chunks since it wouldn’t make sense to involve hundreds/thousands of people in the operations of a SaaS product.

![[optijpeg output image] [optijpeg output image]](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fcb65f607-259a-4e0a-a678-746e53267696_480x270.jpeg)

![[png-to-webp output image] [png-to-webp output image]](https://substackcdn.com/image/fetch/w_2400,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fc56e13e3-aa76-4cdb-a1c4-8b368bf387de_3308x716.webp)

![[png-to-webp output image] [png-to-webp output image]](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fe5949669-64e2-4c24-b104-4c1bb1ecf72f_743x350.webp)

![[png-to-webp output image] [png-to-webp output image]](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2F391dc661-1ba2-4a87-bcb8-c4ce52fd81ef_1072x1023.webp)

![[optiwebp output image] [optiwebp output image]](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fc83daba1-e404-4736-b0f8-4899b1b5590a_955x977.webp)

![[resize output image] [resize output image]](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2F3695dd0d-77b0-40a1-a502-54866da0399d_917x961.webp)