Exposing the myth of linear Micro-SaaS growth

How to grow really big, really fast

In my career as a growth-focused startup guy, I’ve had the chance to work on dozens of SaaS products across all kinds of verticals.

And I’d say that 90% of the time, the general perspective on achieving hypergrowth ranges from woah there cowboy to we’d run out of money:

Raise your hand if you’ve ever heard something along the lines of:

Exponential SaaS growth is impossible. All SaaS growth is linear.

It takes a long, long time to grow a SaaS and you must be prepared for a slow, steady climb to your MRR goal.

I’m here to debunk this ridiculous claim once and for all.

Over the last few years, SaaS has become the go-to business model for indie hackers looking to bootstrap profitably over time.

We like the SaaS business model because of monthly recurring revenue, and we all generally agree on the role churn plays in the SaaS equation; high churn will inevitably kill a SaaS product.

If we build a small enough product, focusing hard on churn is easy because you’re nimble by design, and can deploy relatively big changes to effect an equivalent increase in retention.

Why churn is important for SaaS

You can’t grow a SaaS if the revenue you work hard to acquire leaks away a few short months after being acquired.

There’s this idea that you could be spending a bunch of money on day 0 (cost of customer acquisition) knowing how long it should approximately take for you to break-even and start becoming totally profitable on that customer.

But if your customer is churning (re: unsubscribing, leaving) before they’ve paid you back, you’re going to get into trouble.

Worse, if your customer churns soon after signing up, that’s an indication that the product isn’t well positioned to answer a pain or that the wrong type of customers are signing up for your SaaS.

The effect of churn on a SaaS business

Churn slows down your growth rate.

When you calculate how much net revenue you make each month, you take your MRR and subtract it by the revenue lost to churn that month.

You can do this with logo (customer) churn too.

If I start the month with 100 customers, acquire 50 customers during the month but lose 30, I end the month at 120 customers.

I grew, but my churn rate is 30%!

It means one third of my entire customer base left on that month.

Luckily, we’re acquiring more customers, but you can see how this would reduce your ability to grow faster.

Conventionally dealing with churn

Generally, there’s this confusing idea that “churn is inevitable”.

I literally can’t stand it.

It’s fair to assume that up to 1-2% of your paying users might choose to walk away each month.

Granted you are at least growing a little bit, that churn should be negligible. So churn itself is “inevitable”.

In the early days, it is common to experience high churn.

Your product is young, you’re still figuring out who your customer is, and there’s time ahead to be spent on honing in against those parameters.

But the error comes once you zoom in. People look at the churn, hunch their shoulders and say welp, churn is inevitable. 🤷

Sure, every growth marketer looking at churn will decide to take action against it — usually in the form of onboarding changes, customer success or by looking at user behaviour in-product.

But this comfortable thinking that having churn is going to be a reality moving forward seriously bothers me.

So here’s the higher resolution picture on this.

Negative churn is the real goal

Let’s take a hypothetical SaaS business.

Its business model is generic: it offers a limited offering, in the form of a trial or free experience, which then has some conversion rate to a subscription.

The funnel looks something like this:

Visitor hits the home page

Chooses to start a free trial (or free account)

Eventually, some % of the free users end up converting to the paid subscription

Some customers eventually churn.

Sounds about right?

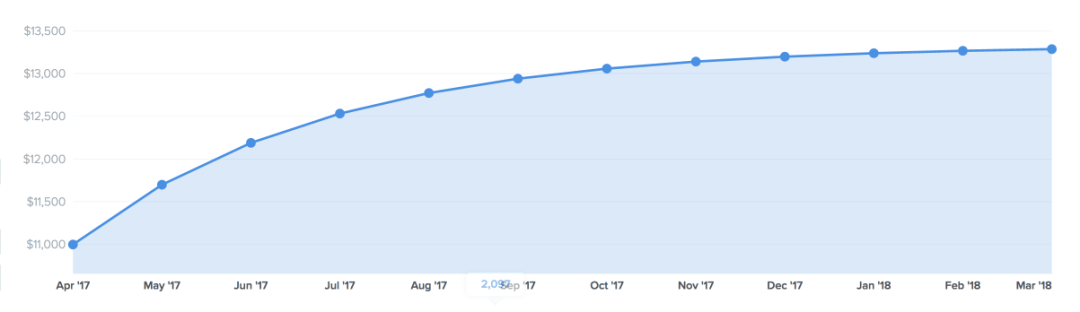

Let’s say the company is at $10K MRR right now and is adding $4K MRR every month from its organic efforts, Not bad!

Say the churn rate is at our extreme 30% example.

As a reminder, this is calculated by taking the total amount of revenue lost by the end of the month and dividing it by the total number of active subscribers at the beginning of the month.

At 30%, that means that for every 10 users you have at the start of the month, 3 will leave over the course of that month.

This is the result:

If your business is growing linearly, that goes to say that every single month, it brings in $4,000 in new revenue, but you lose 30% of the users you had at the beginning of that month, the growth rate gets totally squished.

In fact, the revenue eventually caps out at around $13.5k MRR because of that churn.

The only way to make the business grow again is either by adding more revenue (which is hard) or by making your product and customer success effect work to reduce the number of people who choose to part ways with your software.

How do you solve churn?

Now this is an interesting question you’re going to get a lot of different answers to.

The first go-to answer, which is correct, is to focus on product.

Is your product actually useful?

Is it responding to the customers’ pain adequately and consistently and creating way more value than it charges for?

Then there’s the classic: “it’s not the right customer.”

This can also be true, thousands of startups die every year failing to capture market/product fit. They let it slip.

There is little sense in spending a year creating a product without ever interacting with your intended user.

That’s why bootstrapping is now synonymous with building in public.

Assume your product is in fact quite good and that you’ve found a fit with the right market.

The market is accepting your product to solve their problem, but they are still churning. Then what?

Customer success is one of the super powers of SaaS. There’s little doubt now that most of the improvements are locked away in the way you onboard people into your product.

Ensure your customers are actually successful using your product to create value for themselves and their businesses and they’ll stick around.

This is the cornerstone of low churn, and sure, it requires good market/product fit, but the product also needs to work. People need to be getting regular value from it, whether they actively use the product or not is totally irrelevant.

Focuse on the way people use your product and implement some changes to help them move through the lifecycle.

Applications like Intercom make customer success highly sophisticated by automating the process of reaching out to your customers and help inch them closer to success.

That’s something to consider when you try to systemize a process of giving support that is working. To find that, you need to have spent a lot of time manually speaking to your customers or being the customer yourself.

There’s no shortcut to that.

Not a Magic Pill

Here’s where things get a little hazy.

As a marketer, your reliance on customer success grants you the comfort that low-hanging fruits are being picked:

We are tracking our users and how they use our product and helping them reach their goals ourselves with quality messaging support and a knowledge-base for self-service.

Yet we still get churn. “Inevitably”.

The truth is that customer success on its own is not enough to get past the ticking bomb that is churn.

Some other force needs to be at work to help you pad that effort.

What is that force?

Revenue Expansion let’s gooooo 🚀

Upgrades dramatically increase customer lifetime value and increase the ceiling of your customer acquisition costs.

They also do something far, far more powerful than that:

Revenue expansion counteracts the effects of churn

Most SaaS businesses offer a Pro subscription type of offering. Sometimes the offering is tiered into 2, 3 or more packages.

This represents a unidimensional way for the SaaS to monetize:

The user subscribes, and then the SaaS bills the user based on their plan every month thereafter (until churn).

That’s how you get linear growth.

Upgrades allow SaaS business models to become multidimensional, because while the customer is subscribing to a Pro account to gain access to additional value-added features, they are also being billed relative to the value delivered.

As the volume of received value grows (from being successful with the product), additional charges are billed.

You can intuitively get a picture of this with something like Mailchimp. They charge, say, $10/mo to access the software’s full feature set.

Included in this feature set is the ability to manage subscribers, send emails, perform marketing automation and so forth.

A successful Mailchimp user will see a growing number of emails sent or subscribers being added to the app over time.

Mailchimp has a second billing dimension that charges users based on how many contacts they have in their database.

When you pass 500 contacts, your subscription charge graduates:

$10 → 0 - 500 contacts

$19 → 501 - 1,000 contacts

$28 → 1,000 - 2,500 contacts

etc.

Exponential SaaS Revenue From Negative Churn

Mailchimp’s second billing dimension introduces revenue expansion which causes their revenue growth to skyrocket.

The product is successful at making its users successful, which causes those customers to be billed additionally every month.

Customers are totally OK with it because they’re getting the same relative value over time against that spend.

If I’m OK with spending $1 in exchange for $5, I’m also OK with spending $2 to make $10.

If your customers are becoming more and more successful over time, it’s reasonable to assume that a SaaS that is growing linearly will start to see more and more of its revenue coming from upgrades, rather than from its regular trickle of new customers.

And the key is for the revenue coming in from expansion to match or outpace the revenues lost to churn.

Now for the money question:

What happens when revenue expansion does outpace churn?

You get delicious exponential growth:

Instead of flatlining, a product with expansion that outpaces churn is able to grow even faster because:

it gets to keep every single new customer who signs up

it gets an extra growth boost created by the difference between upgrades and churn (i.e. $4k upgrades vs. $3k churn = +$1k extra boost on top of new MRR each month)

How to engineer negative churn

Reaching the point of negative churn is a multi-step scenario.

First and foremost, do the “just fix it” stuff.

Get the product in order.

Ensure you’re reaching the market profitably and consistently.

Make sure your onboarding absolutely shreds.

Then look at the churn rate resulting from all of this basic infrastructure and consider just how intense the negative pressure created by your churn is vis—a-vis MRR growth and expansion.

Generally, you want to aim for 1%-2% net monthly churn.

That is next to impossible to achieve without upgrades.

Churn for a Micro-SaaS tends to be more extreme than well-built, mature SaaS platforms with many features. So you might see churn ranging from 5% up to as much as 20%.1

Just to be clear, if you’ve got a 5% monthly churn rate… that means that after having acquired 1,000 customers over the year, you’ll have lost the equivalent of 600 of that timeframe, stifling the size of your business by over 2.5x . Not good!

Once you reach a “stable” churn rate, start to engineer pricing changes that align with the way your customers use your product:

Use value-based pricing for your core subscription offer (i.e. the Pro subscription tiers) and use a really low price to get subscriptions sold.

Use capacity-based pricing for your upgrades (i.e. number of emails send) to expand the amount you bill from customers

You should end up with a multi-dimensional billing model which bills additionally based on users’ growth inside of your product, while capturing actual customers by provided value-added “pro” features.

Once you’ve reached the point of multidimensional pricing, the revenue generated from the expansion revenue will go to war against the revenue lost to churn.

From there, you should aim to get to 1-2% net churn or so.

If you’re really gunning for exponential results though, you’ll continue to fight until the revenue you make from expansions outpaces the revenue lost to churn, and then some.

When that happens, queue exponential growth. The product’s valuation just doubled. 🚀

I recently passed on a $10k MRR SaaS because monthly revenue growth is 30% but revenue churn is also 30%.

If revenue stops growing as quickly for any reason, the SaaS would be looking at a net-zero event within 4 short months.

That MRR would evaporate faster than you can click to subscribe and support the newsletter. :)